Ever feel like you're walking a tightrope when making online deals? Trusting someone you've never met with your hard-earned money can be nerve-wracking. What if they don't deliver? What if you're not satisfied with the service? It's a digital Wild West out there, and finding a secure path through it is essential.

The uncertainty surrounding online transactions can lead to hesitation, missed opportunities, and even outright scams. The back-and-forth negotiations, the constant worry about payment security, and the potential for misunderstandings can all add up to a stressful and time-consuming experience. Often, people are left wondering if there's a better, safer way to do business online.

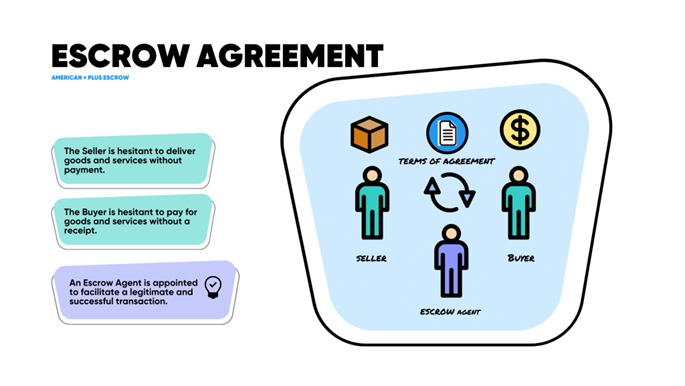

This is where escrow services and automated agreements swoop in to save the day! They offer a secure and efficient way to conduct transactions, ensuring that both parties fulfill their obligations before funds are released. Think of it as a neutral third party holding the money and making sure everyone plays fair. But how exactly do these services work, and why are they so important in today's digital landscape?

In essence, escrow services act as trusted intermediaries, holding funds securely until the terms of an agreement are met. Automated agreements, often powered by smart contracts, streamline the process by codifying the terms and automatically executing them when the conditions are satisfied. This combination creates a transparent, efficient, and secure environment for online transactions, minimizing risk and fostering trust between parties. Keywords like escrow, automated agreements, smart contracts, online security, and digital transactions are key to understanding this process.

Escrow Services: Your Digital Handshake

I remember the first time I bought something significant online from a private seller. It was a vintage camera lens, and the seller seemed reputable, but I couldn't shake the feeling of anxiety as I hit the "send money" button. What if the lens arrived damaged, or worse, never arrived at all? I wish I had known about escrow services back then; it would have saved me a lot of sleepless nights! Escrow services operate like a digital handshake, providing a secure environment for transactions. They hold the buyer's funds until the seller fulfills their obligations, such as delivering the goods or services as agreed. Once the buyer confirms satisfaction, the funds are released to the seller. This simple mechanism significantly reduces the risk of fraud and disputes, making online transactions safer and more reliable. Think of it as having a trusted friend hold the money until everyone is happy. This is especially important for high-value transactions, international deals, or situations where there is little pre-existing trust between the parties. The security and peace of mind offered by escrow services are invaluable in the often-uncertain world of online commerce. Beyond simple buying and selling, escrow services can also be used for things like domain name transfers, software development projects, and even real estate transactions. The versatility of escrow makes it a valuable tool for anyone conducting business online.

How Automated Agreements Work

Automated agreements, often powered by smart contracts, take the concept of escrow to the next level. Instead of relying on a human escrow agent, these agreements are self-executing pieces of code that automatically enforce the terms of a contract. Imagine a scenario where you're hiring a freelancer to design a logo. With an automated agreement, you could deposit the payment into a smart contract. The freelancer would then be given access to the funds as they complete certain milestones, such as submitting initial design concepts, revisions, and the final product. Once you approve the final logo, the smart contract automatically releases the remaining payment to the freelancer. This entire process is transparent, auditable, and tamper-proof, eliminating the need for manual intervention and reducing the risk of disputes. The beauty of automated agreements lies in their efficiency and reliability. They eliminate the need for intermediaries, reduce transaction costs, and ensure that agreements are enforced fairly and consistently. They are particularly useful for situations where the terms of the agreement are well-defined and can be easily translated into code. Furthermore, automated agreements can be integrated with other systems, such as payment gateways and project management tools, to create a seamless and streamlined workflow. This makes them an increasingly attractive option for businesses of all sizes looking to improve their efficiency and reduce their risk exposure.

The History and Myths of Escrow

The concept of escrow isn't new; it dates back centuries! Historically, escrow was used primarily in real estate transactions to ensure a fair and secure transfer of property ownership. However, with the rise of e-commerce, escrow services have adapted to the digital age, providing a crucial layer of protection for online transactions. One common myth is that escrow services are only necessary for high-value transactions. While they are certainly beneficial in those situations, they can also be valuable for smaller transactions where trust is lacking or where the risk of fraud is higher. Another misconception is that escrow services are expensive. While there are fees associated with using these services, they are often a small price to pay for the peace of mind and security they provide. Moreover, the fees can often be negotiated between the buyer and seller. It's also important to distinguish between legitimate escrow services and fraudulent websites that masquerade as escrow providers. Always do your research and choose a reputable escrow service with a proven track record. Look for companies that are licensed and bonded, and that have positive reviews from other users. Furthermore, be wary of any escrow service that asks you to send funds via unconventional methods, such as wire transfers or gift cards. A legitimate escrow service will typically offer a variety of secure payment options. By understanding the history and dispelling the myths surrounding escrow, you can make informed decisions about whether it's the right choice for your online transactions.

Unlocking the Hidden Secrets of Secure Transactions

One of the hidden secrets of escrow services is their ability to facilitate cross-border transactions with greater ease and security. When dealing with international buyers or sellers, it can be challenging to establish trust and navigate different legal systems. Escrow services provide a neutral platform that mitigates these risks, ensuring that both parties are protected regardless of their location. Another hidden benefit is the ability to use escrow services as a dispute resolution mechanism. If a disagreement arises between the buyer and seller, the escrow agent can act as a mediator, helping to resolve the issue and ensure a fair outcome. This can save both parties time and money by avoiding costly legal battles. Furthermore, escrow services can be used to protect intellectual property rights. For example, a software developer could use escrow to deposit the source code of their software. The buyer would only gain access to the code once they have fulfilled their payment obligations. This protects the developer's intellectual property while providing the buyer with assurance that they will receive the product they paid for. The key to unlocking these hidden secrets is to understand the full range of services offered by different escrow providers and to choose one that aligns with your specific needs. Don't be afraid to ask questions and to negotiate the terms of the escrow agreement. By doing so, you can leverage the power of escrow to create a more secure and efficient online transaction experience.

Recommendations for Using Escrow and Automated Agreements

Before engaging in any online transaction, take the time to assess the risk involved and determine whether escrow or automated agreements are necessary. For high-value transactions, deals with unfamiliar parties, or situations where there is a high potential for disputes, these services are highly recommended. When choosing an escrow provider, look for a reputable company with a proven track record. Check their licensing, bonding, and reviews from other users. Also, make sure they offer secure payment options and have a clear dispute resolution process. For automated agreements, consider using a platform that offers templates and tools to help you create smart contracts easily. These platforms can guide you through the process of defining the terms of your agreement and deploying the smart contract on a blockchain. It's also important to clearly communicate the terms of the agreement to all parties involved. Make sure everyone understands their obligations and what happens if those obligations are not met. When using escrow, be sure to inspect the goods or services carefully before releasing the funds to the seller. If you are not satisfied with the product, notify the escrow agent immediately and follow their dispute resolution process. Finally, remember that escrow and automated agreements are tools to help you manage risk and ensure fair outcomes. They are not a substitute for due diligence and good communication. Always do your research, ask questions, and be prepared to walk away from a deal if it doesn't feel right.

Understanding the Nuances of Smart Contracts

Smart contracts are self-executing contracts written in code and stored on a blockchain. They automatically enforce the terms of an agreement when certain conditions are met. For example, a smart contract could be used to automate the payment of royalties to musicians based on the number of times their songs are played online. The smart contract would track the plays and automatically distribute the royalties to the appropriate accounts. Smart contracts offer several advantages over traditional contracts, including increased efficiency, transparency, and security. They eliminate the need for intermediaries, reduce transaction costs, and ensure that agreements are enforced fairly and consistently. However, smart contracts also have some limitations. They are difficult to modify once deployed on the blockchain, and they can be vulnerable to bugs or security flaws. It's important to carefully audit and test smart contracts before deploying them to ensure that they are working as intended. Furthermore, the legal status of smart contracts is still evolving. In some jurisdictions, they are legally enforceable, while in others, they are not. It's important to consult with a legal professional to understand the legal implications of using smart contracts in your jurisdiction. Despite these challenges, smart contracts have the potential to revolutionize the way we conduct business online. They can be used to automate a wide range of processes, from supply chain management to voting systems to insurance claims. As the technology matures and the legal framework becomes clearer, smart contracts are likely to become an increasingly important part of the digital economy.

Tips for Maximizing Security with Escrow and Automated Agreements

To maximize security when using escrow services, always choose a reputable provider that is licensed and bonded. Verify their credentials and read reviews from other users before entrusting them with your funds. Use strong passwords and enable two-factor authentication to protect your account from unauthorized access. Be wary of phishing scams and never click on links in emails from unknown senders. Always access the escrow service's website directly by typing the URL into your browser. When creating automated agreements, use a platform that offers security audits and vulnerability assessments. Carefully review the code before deploying the smart contract to ensure that it is free of bugs and security flaws. Consider using a decentralized escrow service that uses smart contracts to manage the funds and enforce the terms of the agreement. This can provide an extra layer of security and transparency. Regularly monitor your transactions and report any suspicious activity to the escrow provider or the smart contract platform. Stay informed about the latest security threats and vulnerabilities in the escrow and smart contract ecosystems. By following these tips, you can significantly reduce your risk of fraud and ensure that your online transactions are secure.

The Role of Blockchain in Enhancing Trust

Blockchain technology plays a crucial role in enhancing trust in escrow and automated agreement systems. By storing transaction data on a decentralized and immutable ledger, blockchain ensures that the terms of the agreement are transparent and tamper-proof. This eliminates the need for a central authority to verify the transactions and reduces the risk of fraud or manipulation. Furthermore, blockchain can be used to create decentralized escrow services that are not controlled by any single entity. These services are more resistant to censorship and can provide greater transparency and security. Smart contracts, which are often deployed on blockchain platforms, can automate the execution of agreements based on predefined conditions. This eliminates the need for manual intervention and reduces the risk of human error. The use of cryptographic techniques, such as digital signatures and encryption, further enhances the security of blockchain-based escrow and automated agreement systems. These techniques ensure that the transactions are authenticated and protected from unauthorized access. Overall, blockchain technology provides a robust and secure foundation for building trust in online transactions. By leveraging the power of decentralization, transparency, and cryptography, blockchain can help to create a more efficient and equitable digital economy.

Fun Facts About Escrow and Automated Agreements

Did you know that the term "escrow" comes from the Old French word "escroue," which means a scrap of paper or parchment? This refers to the original practice of using a written document to outline the terms of an agreement held in trust. Another fun fact is that the first smart contract was created in 1994 by Nick Szabo, a computer scientist and cryptographer. He envisioned smart contracts as a way to automate and enforce agreements in the digital world, long before the advent of blockchain technology. While escrow services have been around for centuries, their use in online transactions has exploded in recent years, driven by the growth of e-commerce and the increasing need for security and trust. Smart contracts are now being used in a wide range of industries, from finance and healthcare to supply chain management and voting systems. The potential applications of smart contracts are virtually limitless. Some experts predict that smart contracts will eventually replace many traditional contracts, leading to a more efficient and automated legal system. While the future of escrow and automated agreements is uncertain, one thing is clear: they are playing an increasingly important role in the digital economy, helping to build trust and facilitate secure transactions in a world where trust is more important than ever.

How to Choose the Right Escrow Service

Choosing the right escrow service is crucial for ensuring a secure and successful online transaction. Start by researching different providers and comparing their fees, services, and reputation. Look for companies that are licensed and bonded, and that have positive reviews from other users. Pay attention to the escrow service's security measures, such as encryption and two-factor authentication. Make sure they offer secure payment options and have a clear dispute resolution process. Consider the type of transaction you are conducting and choose an escrow service that specializes in that area. For example, some escrow services focus on real estate transactions, while others specialize in domain name transfers or software development projects. Read the escrow agreement carefully and make sure you understand all of the terms and conditions. If you have any questions, don't hesitate to contact the escrow service for clarification. Be wary of any escrow service that asks you to send funds via unconventional methods, such as wire transfers or gift cards. A legitimate escrow service will typically offer a variety of secure payment options. Finally, trust your gut. If something feels off about an escrow service, it's best to err on the side of caution and choose a different provider. By following these tips, you can choose the right escrow service and protect yourself from fraud.

What If Escrow Services Didn't Exist?

Imagine a world without escrow services. Online transactions would be significantly riskier, and trust between buyers and sellers would be much lower. The incidence of fraud and disputes would likely increase, making people more hesitant to engage in online commerce. The lack of security would stifle innovation and growth in the digital economy. Cross-border transactions would be particularly challenging, as it would be difficult to establish trust between parties in different countries. The cost of doing business online would likely increase, as businesses would need to invest more in security measures and fraud prevention. Small businesses and individuals would be at a particular disadvantage, as they would lack the resources to protect themselves from fraud. Overall, a world without escrow services would be a less secure and less efficient place for online commerce. The absence of this crucial layer of protection would make it more difficult for buyers and sellers to connect, and it would stifle the growth of the digital economy. Escrow services play a vital role in building trust and facilitating secure transactions in the online world, and their absence would have a significant negative impact.

Top 5 Reasons to Use Escrow Services

Here's a quick listicle highlighting the top 5 reasons to use escrow services:

- Enhanced Security: Escrow protects your funds and ensures that both parties fulfill their obligations.

- Reduced Risk of Fraud: Escrow minimizes the risk of scams and fraudulent transactions.

- Dispute Resolution: Escrow services provide a neutral platform for resolving disagreements between buyers and sellers.

- Increased Trust: Escrow fosters trust between parties, especially in transactions with unfamiliar individuals or businesses.

- Streamlined Transactions: Escrow simplifies the transaction process and ensures that funds are released promptly once the terms of the agreement are met.

Question and Answer

Q: What are the fees associated with using escrow services?

A: Escrow fees vary depending on the provider and the type of transaction. They are typically a percentage of the transaction amount and can be negotiated between the buyer and seller.

Q: How do I know if an escrow service is legitimate?

A: Look for companies that are licensed and bonded, and that have positive reviews from other users. Be wary of any escrow service that asks you to send funds via unconventional methods.

Q: What happens if there is a dispute between the buyer and seller?

A: The escrow agent will typically act as a mediator to help resolve the dispute. If a resolution cannot be reached, the escrow agent may need to involve a third-party arbitrator or a court of law.

Q: Can I use escrow services for all types of online transactions?

A: Escrow services can be used for a wide range of online transactions, including the purchase of goods, services, domain names, and even real estate.

Conclusion of How Escrow Services and Automated Agreements Works and Why It’s Important

Escrow services and automated agreements are essential tools for navigating the complexities and risks of the digital world. They provide a secure, transparent, and efficient way to conduct online transactions, fostering trust and minimizing the potential for fraud and disputes. By understanding how these services work and choosing reputable providers, you can protect yourself and your business and participate in the digital economy with confidence.