Ever felt like striking a deal shouldn't involve so much… anxiety? What if you could shake hands (virtually, of course) knowing that everyone's protected, every 'i' is dotted, and every 't' is crossed, all without the endless back-and-forth?

Let's be honest. Navigating agreements can feel like wading through treacle. The fear of misunderstandings, the worry about potential scams, and the sheer amount of paperwork can make even the simplest transactions feel like a high-stakes gamble. Wouldn't it be amazing to simplify the process?

That's where escrow services and automated agreements come in. This guide will walk you through how to leverage these tools to create smoother, safer, and more efficient transactions. We'll break down the basics, explore real-world examples, and provide you with practical steps to get started today. Get ready to unlock a world of secure and streamlined deals!

This article provides an overview of how to get started with escrow services and automated agreements. It touches upon the benefits of secure transactions, the simplification of complex agreements, and the reduction of risks associated with traditional methods. Key concepts include escrow accounts, automated agreement platforms, digital signatures, and dispute resolution mechanisms. It will also dive into the potential applications across various industries, such as freelancing, real estate, and e-commerce. These modern tools have the ability to help everyone involved.

Understanding Escrow Services

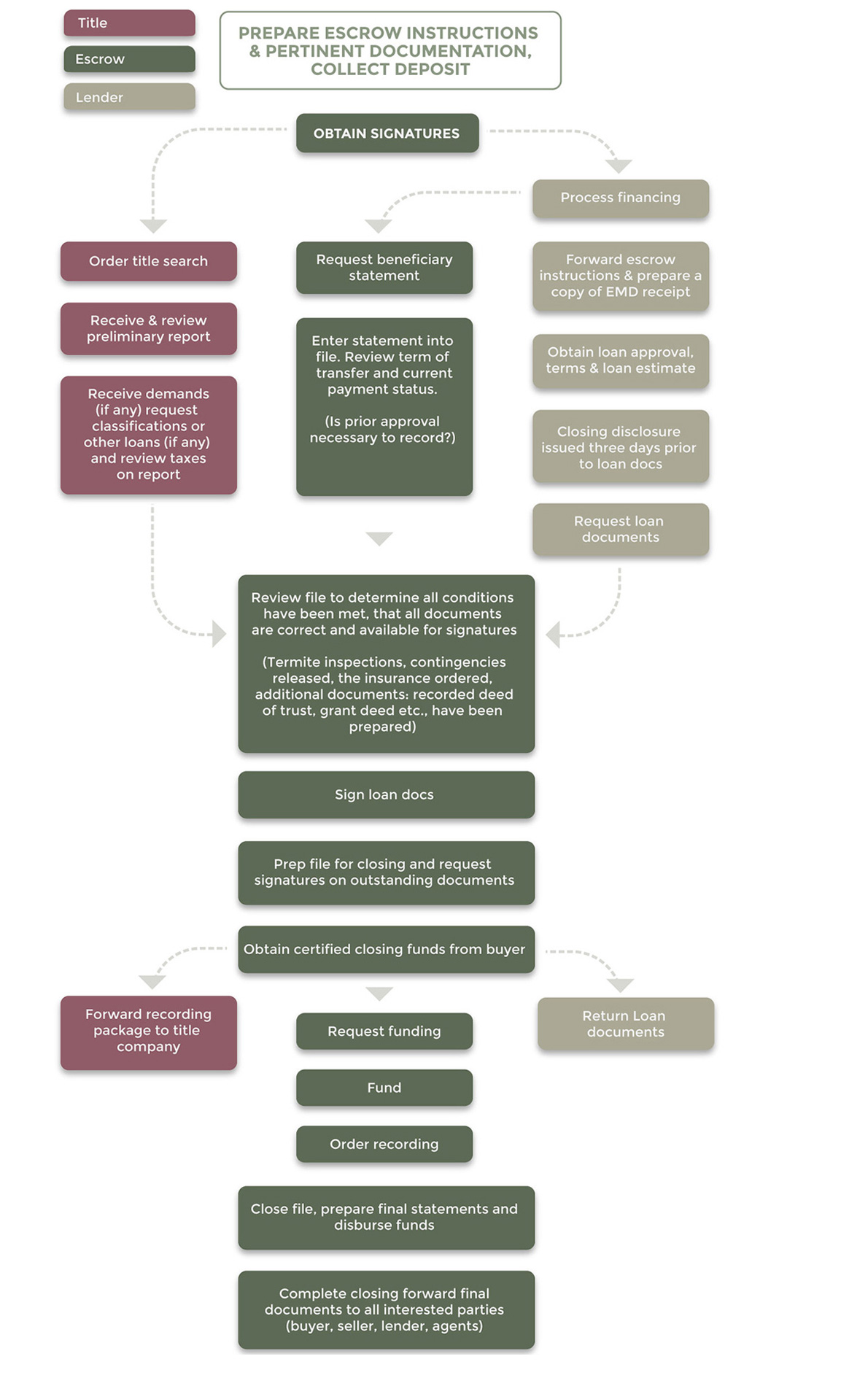

Escrow services act as a neutral third party, holding funds or assets until specific conditions outlined in an agreement are met. The goal is to protect both the buyer and the seller, fostering trust and mitigating risk. My first experience with escrow was selling a vintage motorcycle online. I was naturally nervous about shipping such a valuable item to someone I'd never met. The buyer suggested using an escrow service, and I'm so glad they did. It provided a layer of security that allowed me to ship the bike with confidence, knowing that I would only release ownership after receiving confirmation of payment and the buyer's satisfaction. This experience highlighted the peace of mind that escrow services can provide. Essentially, the buyer deposits the funds with the escrow company. Once the buyer receives the goods or services as described and approves them, the escrow company releases the funds to the seller. This simple process eliminates the "he said, she said" scenario and ensures fair play for everyone involved. Escrow services aren't just for big transactions; they can be used for anything from buying a used car to hiring a freelancer for a project, providing security and peace of mind to all parties. The key advantage is that this arrangement protects both parties from fraud. In essence, the concept is very straightforward and beneficial.

The Power of Automated Agreements

Automated agreements leverage technology to streamline the creation, execution, and management of contracts. Think of it as having a digital assistant that helps you draft, negotiate, and track your agreements, all in one place. The beauty of automated agreements lies in their ability to remove ambiguity and ensure compliance. They often come with built-in templates, clauses, and workflows that guide you through the process, ensuring that nothing is overlooked. Moreover, they often integrate with other tools like e-signature platforms and CRM systems, further simplifying the agreement lifecycle. For example, imagine you're a freelancer who frequently works with different clients. Instead of manually drafting a new contract for each project, you could use an automated agreement platform to create a standardized contract template that you can easily customize with the client's details and project specifics. This not only saves time but also reduces the risk of errors or omissions. These type of system are a true time saving opportunity. The benefits are clear and easy to see and use.

A Brief History and the Myths Surrounding These Concepts

Escrow, in its earliest forms, can be traced back to ancient civilizations where trusted individuals acted as intermediaries to facilitate trade and property transfers. The concept evolved over centuries, becoming more formalized in legal systems. The rise of automated agreements is a more recent phenomenon, driven by advancements in technology and the increasing need for efficient contract management in the digital age. One common myth surrounding escrow is that it's only for large or complex transactions. While it's certainly valuable for high-value deals like real estate purchases, it can also be incredibly beneficial for smaller transactions, such as online sales or freelance projects. Another myth is that automated agreements are impersonal and lack the flexibility of traditional contracts. While it's true that they rely on templates and pre-defined clauses, most platforms allow for customization and negotiation to accommodate specific needs. In fact, automation can often lead to more transparent and consistent agreements, reducing the risk of misunderstandings. The fact is that Escrow provides an opportunity for all parties involved to feel safe. Automated agreements helps reduce the amount of time a transaction takes to be formalized.

Unveiling the Hidden Secrets and Overlooked Benefits

One of the most overlooked benefits of escrow services is their ability to facilitate cross-border transactions. When dealing with international buyers or sellers, trust can be a significant barrier. Escrow provides a neutral ground, ensuring that funds are protected and that both parties fulfill their obligations. Another hidden secret is the dispute resolution mechanisms that often come with escrow services. In the event of a disagreement, the escrow company can act as a mediator, helping to find a fair and amicable solution. This can save time, money, and stress compared to pursuing legal action. On the automated agreement front, a key secret lies in the data and analytics they provide. By tracking key metrics like contract completion rates, negotiation timelines, and common areas of dispute, you can gain valuable insights into your business processes and identify areas for improvement. This data-driven approach can help you optimize your agreements and improve your overall efficiency. In addition, the benefits of using these system are numerous, like time saving and less of a change of a dispute.

Recommendations for Getting Started Today

If you're ready to embrace the power of escrow services and automated agreements, here are some practical recommendations to get you started. First, research and compare different escrow service providers and automated agreement platforms. Look for reputable companies with a proven track record and positive reviews. Consider factors like fees, features, customer support, and integration capabilities. Second, start small. Don't try to overhaul your entire contracting process overnight. Instead, identify a specific area where you can pilot these tools, such as a particular type of transaction or a specific team within your organization. This will allow you to learn the ropes and fine-tune your approach before scaling up. Third, invest in training and education. Make sure your team understands how to use the tools effectively and how to leverage their features to their full potential. Many providers offer training resources and support to help you get started. Finally, don't be afraid to experiment and iterate. The best way to find what works for you is to try different approaches and learn from your experiences. Continuously evaluate your processes and make adjustments as needed to optimize your results. These are just a few of the many steps to take to ensure successful integration into these new technologies.

Exploring the Legal and Regulatory Landscape

Escrow services and automated agreements are subject to various legal and regulatory requirements, which can vary depending on the jurisdiction and the type of transaction involved. It's essential to understand these requirements to ensure compliance and avoid potential legal issues. Escrow services, for example, are often regulated by state or federal agencies that oversee financial institutions. These regulations may cover areas like licensing, bonding, auditing, and consumer protection. Automated agreements, on the other hand, may be subject to laws governing electronic signatures, data privacy, and contract enforceability. Some jurisdictions may have specific laws that address the validity and enforceability of electronic contracts. It's also important to consider the legal implications of using automated agreement platforms in cross-border transactions. Different countries may have different laws regarding contract formation, choice of law, and dispute resolution. To navigate this complex landscape, it's advisable to consult with legal counsel who specializes in contract law and digital transactions. They can help you understand the applicable laws and regulations, draft compliant agreements, and mitigate potential legal risks. In addition, ensuring that all processes are compliant will increase trust between parties.

Essential Tips for Successful Implementation

Implementing escrow services and automated agreements requires careful planning and execution. Here are some essential tips to ensure a successful implementation: Define your goals and objectives. What do you hope to achieve by using these tools? Are you looking to reduce risk, improve efficiency, or enhance customer satisfaction? Clearly defining your goals will help you choose the right tools and measure your success. Involve stakeholders from across your organization. Get input from legal, finance, sales, and other relevant departments to ensure that the implementation meets their needs and requirements. Develop clear policies and procedures. Document how escrow services and automated agreements will be used within your organization, including guidelines for contract drafting, negotiation, and dispute resolution. Communicate effectively with your stakeholders. Keep them informed about the implementation process, its benefits, and any changes to existing policies and procedures. Provide ongoing training and support. Ensure that your team has the knowledge and skills they need to use the tools effectively and address any questions or concerns they may have. By following these tips, you can increase your chances of a successful implementation and reap the full benefits of escrow services and automated agreements. The keys to success are knowledge and training.

Addressing Security Concerns and Data Privacy

Security and data privacy are paramount when dealing with escrow services and automated agreements. It's essential to choose providers that have robust security measures in place to protect sensitive data from unauthorized access, theft, or misuse. Look for providers that comply with industry standards and regulations, such as PCI DSS for payment card data and GDPR for personal data. These standards require providers to implement technical and organizational measures to ensure the confidentiality, integrity, and availability of data. In addition to choosing reputable providers, it's also important to implement your own security measures, such as strong passwords, multi-factor authentication, and regular security audits. Educate your team about security best practices and train them to identify and respond to potential threats. Data privacy is another critical consideration. Make sure you understand how your chosen providers collect, use, and share your data. Review their privacy policies carefully and ensure that they comply with applicable data privacy laws, such as GDPR and CCPA. Obtain consent from individuals before collecting their personal data and provide them with clear and transparent information about how their data will be used. By addressing security concerns and data privacy proactively, you can build trust with your customers and partners and protect your organization from potential risks.

Fun Facts About Escrow and Automated Agreements

Did you know that the term "escrow" comes from the Old French word "escroue," which means a scrap of paper or parchment? This refers to the original practice of using written documents to outline the terms of an escrow agreement. Another fun fact is that automated agreements are not just for business transactions. They can also be used for personal matters, such as creating prenuptial agreements or wills. The first automated agreement platform was launched in the late 1990s, but it wasn't until the 2010s that the technology really took off, thanks to advancements in cloud computing and e-signature technology. Some automated agreement platforms even use artificial intelligence to analyze contracts and identify potential risks or opportunities. The largest escrow transaction in history was the acquisition of Time Warner by AOL in 2001, which involved an escrow account of over $164 billion. These fun facts highlight the rich history and evolving nature of escrow services and automated agreements, and their growing importance in the modern world. The use of these technologies is only going to increase in the coming years. The future is now!

Step-by-Step Guide: Getting Started

Ready to dive in? Here’s a step-by-step guide to get you started with escrow services and automated agreements: Step 1: Identify Your Needs. What types of transactions do you want to secure with escrow? What kind of agreements do you need to automate? Understanding your specific needs will help you choose the right tools and providers. Step 2: Research and Compare Providers. Look for reputable escrow service providers and automated agreement platforms. Consider factors like fees, features, customer support, and integration capabilities. Step 3: Sign Up and Set Up Your Account. Once you've chosen your providers, sign up for an account and configure your settings. Step 4: Create or Upload Your Agreements. Use the platform's templates or upload your own contracts. Customize them to fit your specific needs. Step 5: Invite Parties to Review and Sign. Send your agreements to the other parties involved for review and signature. Step 6: Fund the Escrow Account. If using escrow, deposit the funds into the escrow account. Step 7: Monitor the Agreement. Track the progress of the agreement and ensure that all conditions are met. Step 8: Release Funds or Assets. Once all conditions are met, the escrow company will release the funds or assets to the appropriate party. Step 9: Evaluate and Optimize. Continuously evaluate your processes and make adjustments as needed to improve your results. This step-by-step guide will help you navigate the process of getting started with escrow services and automated agreements. These technologies should be viewed as a true value to every organization.

What If Things Go Wrong? Handling Disputes

Despite your best efforts, disputes can sometimes arise even with the use of escrow services and automated agreements. Here's how to handle them effectively: Review the Agreement Terms. The first step is to carefully review the terms of the agreement to understand your rights and obligations. Communicate Openly. Try to resolve the dispute amicably by communicating with the other party and attempting to find a mutually agreeable solution. Utilize Dispute Resolution Mechanisms. If communication fails, utilize the dispute resolution mechanisms provided by the escrow service or automated agreement platform. This may involve mediation, arbitration, or other forms of alternative dispute resolution. Gather Evidence. Collect any relevant evidence to support your claim, such as emails, invoices, or photographs. Consult with Legal Counsel. If the dispute is complex or involves significant legal issues, consult with legal counsel for guidance. Document Everything. Keep a detailed record of all communications, actions, and decisions related to the dispute. Escalate if Necessary. If all else fails, escalate the dispute to a higher authority, such as a regulatory agency or a court of law. By following these steps, you can effectively handle disputes and protect your interests. There are a few things more important than resolving dispute amicably.

Listicle: Top 5 Benefits of Using Escrow and Automated Agreements

Here’s a quick listicle outlining the top 5 benefits of using escrow services and automated agreements: Reduced Risk. Escrow services protect both buyers and sellers from fraud and non-performance. Improved Efficiency. Automated agreements streamline the contract creation and management process, saving time and money. Increased Trust. Escrow and automated agreements foster trust and transparency between parties. Enhanced Compliance. Automated agreements help ensure compliance with legal and regulatory requirements. Better Data Insights. Automated agreement platforms provide valuable data and analytics to optimize your business processes. These are just a few of the many benefits of using escrow services and automated agreements. By leveraging these tools, you can create a more secure, efficient, and transparent business environment. The benefits are hard to ignore.

Question and Answer

Q: What types of transactions are suitable for escrow services?

A: Escrow services can be used for a wide range of transactions, including online sales, real estate purchases, freelance projects, and cross-border transactions.

Q: How much do escrow services typically cost?

A: Escrow fees vary depending on the value of the transaction and the provider. They are typically split between the buyer and seller.

Q: Are automated agreements legally binding?

A: Yes, automated agreements are legally binding as long as they meet the requirements for a valid contract, such as offer, acceptance, and consideration.

Q: What if the other party refuses to sign the automated agreement?

A: If the other party refuses to sign the automated agreement, you may need to negotiate the terms or seek legal advice.

Conclusion of How to Get Started with Escrow Services and Automated Agreements Today

In conclusion, escrow services and automated agreements are powerful tools that can help you create more secure, efficient, and transparent transactions. By understanding the basics, exploring real-world examples, and following the practical steps outlined in this guide, you can start leveraging these tools today to protect your interests, streamline your processes, and build trust with your customers and partners. The future of commerce is here, and it's powered by escrow and automation.