Imagine a world where financial transactions happen in the blink of an eye, governed by immutable code. Sounds exciting, right? But as smart contracts revolutionize finance, a critical question arises: How do we ensure these automated systems comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations? The intersection of decentralized finance (De Fi) and regulatory compliance presents a fascinating, yet complex, challenge.

The speed and anonymity inherent in blockchain technology, while advantageous for innovation, also create avenues for illicit activities. Attempts to remain compliant with existing financial regulations in the novel decentralized world of cryptocurrency are often met with technological and practical limitations.

This blog post delves into the significant risks and challenges in implementing KYC and AML compliance within smart contracts. We'll explore the inherent complexities, practical hurdles, and potential solutions for navigating this evolving landscape. Our goal is to shed light on the key issues impacting the responsible growth of De Fi and the wider blockchain ecosystem.

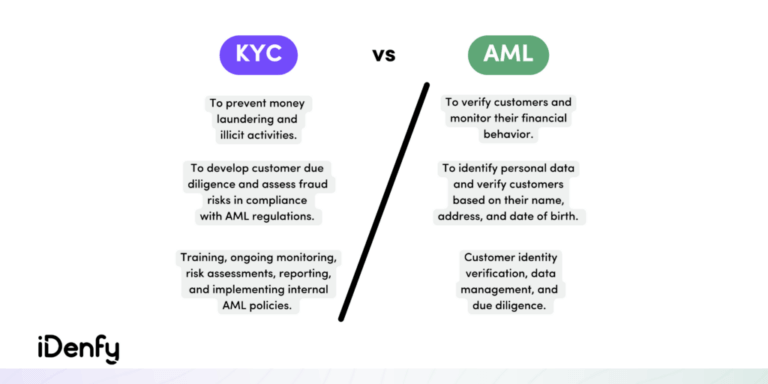

In essence, the journey towards compliant smart contracts is fraught with difficulties. From the inherent tension between privacy and transparency to the technical complexities of integrating KYC/AML measures into decentralized systems, there's much to unpack. We'll consider data privacy concerns, the need for standardized regulatory frameworks, and the ongoing development of technological solutions to bridge the gap between innovation and compliance. Keywords: KYC, AML, Smart Contracts, De Fi, Compliance, Blockchain, Regulations, Risks, Challenges.

Data Privacy vs. Transparency

I remember a conversation I had with a blockchain developer last year. They were adamant that KYC fundamentally undermined the core principles of decentralization. "It's all about privacy," they argued, "and KYC flies in the face of that!" While I understand the sentiment, the reality is that without some level of identity verification, De Fi could become a playground for illegal activities. This is where the tension between data privacy and transparency becomes palpable.

The challenge lies in finding a balance. How do we ensure that users are who they say they are without compromising their personal data? Traditional KYC processes often involve collecting and storing vast amounts of sensitive information, which creates potential honeypots for hackers and raises concerns about data breaches. In a decentralized environment, we need innovative solutions that minimize data collection while still satisfying regulatory requirements. Zero-knowledge proofs, for instance, offer a promising avenue for verifying identity without revealing underlying data. However, these technologies are still in their early stages of development and require further refinement before widespread adoption. The path forward involves carefully navigating this complex terrain, prioritizing user privacy while upholding the integrity of the financial system.

Technical Complexity

Implementing KYC/AML compliance within smart contracts isn't a simple plug-and-play solution. The technical complexities are significant. Smart contracts, by their nature, are immutable, which means that once deployed, they cannot be easily altered to incorporate new regulations or KYC/AML procedures. This presents a major challenge, as regulatory requirements are constantly evolving. Furthermore, integrating KYC/AML checks into decentralized applications (d Apps) requires sophisticated programming and a deep understanding of blockchain technology.

One approach is to use "upgradeable" smart contracts, which allow for certain aspects of the contract to be modified while preserving the core functionality. However, this introduces its own set of risks, as the upgradeability mechanism could be exploited by malicious actors. Another approach is to create "KYC-aware" tokens that can only be transferred between verified users. While this is effective in limiting the potential for illicit activity, it also creates a centralized point of control, which goes against the ethos of decentralization. Ultimately, the technical complexity of implementing KYC/AML compliance in smart contracts requires a multi-faceted approach that combines innovative technologies with careful consideration of the risks and trade-offs involved.

Lack of Standardized Regulations

One of the biggest headaches for developers and businesses operating in the De Fi space is the lack of clear and standardized regulations. Different jurisdictions have different rules regarding KYC/AML compliance, which can create a compliance nightmare for projects that operate globally. What's considered acceptable in one country might be illegal in another. This regulatory uncertainty makes it difficult for businesses to operate with confidence and can stifle innovation. Furthermore, the lack of international cooperation makes it easier for criminals to exploit loopholes in the system.

Imagine a scenario where a De Fi project is based in a country with lax KYC/AML regulations, but its users are primarily located in countries with strict regulations. Which set of rules should the project follow? The answer is not always clear, and the potential for legal challenges is significant. The establishment of clear and standardized regulations is crucial for fostering a healthy and sustainable De Fi ecosystem. This requires international cooperation and a willingness to adapt existing regulations to the unique characteristics of blockchain technology.

Scalability and Efficiency

Implementing KYC/AML checks can be resource-intensive and time-consuming. Traditional KYC processes often involve manual verification of documents and lengthy background checks. This can be a significant bottleneck, especially for De Fi projects that are processing a large volume of transactions. Furthermore, the cost of KYC/AML compliance can be prohibitive for smaller projects.

To address this challenge, there is a growing need for automated KYC/AML solutions that can efficiently verify identities and detect suspicious activity. These solutions can leverage technologies such as artificial intelligence and machine learning to streamline the KYC/AML process and reduce costs. However, it's important to ensure that these solutions are accurate and unbiased. Otherwise, they could lead to unfair or discriminatory outcomes. The scalability and efficiency of KYC/AML compliance are critical factors in the long-term success of De Fi. Finding cost-effective and efficient solutions is crucial for ensuring that De Fi remains accessible to a wide range of users.

The Importance of Ongoing Monitoring

KYC/AML compliance isn't a one-time event. It's an ongoing process that requires continuous monitoring and adaptation. Criminals are constantly developing new methods for evading detection, so it's essential to stay one step ahead. This requires sophisticated monitoring tools that can detect suspicious patterns and identify potential risks. Furthermore, it's important to regularly update KYC/AML procedures to reflect the latest regulatory requirements and best practices.

Ongoing monitoring is especially critical in the context of De Fi, where transactions are often irreversible. Once funds have been transferred to a criminal, it can be difficult or impossible to recover them. Therefore, it's essential to have robust monitoring systems in place to prevent illicit activity from occurring in the first place. This requires a collaborative approach that involves regulators, businesses, and technology providers working together to create a safe and secure De Fi ecosystem. The continuous improvement of monitoring technologies and procedures is vital for maintaining the integrity of the financial system.

Best Practices for KYC and AML Compliance

Implementing effective KYC and AML compliance within smart contracts requires a proactive and thoughtful approach. One crucial step is to conduct a thorough risk assessment to identify potential vulnerabilities and develop mitigation strategies. This involves understanding the specific risks associated with your project and implementing appropriate controls to address those risks. It's also important to establish clear policies and procedures for KYC and AML compliance, and to ensure that all employees and stakeholders are properly trained.

Another best practice is to use a layered approach to KYC and AML compliance. This involves combining multiple methods of identity verification and risk assessment to provide a more comprehensive picture of the user. For example, you might use traditional KYC methods such as identity document verification, along with blockchain analytics tools to identify suspicious transaction patterns. By combining multiple layers of security, you can significantly reduce the risk of illicit activity. The implementation of best practices is essential for building trust and confidence in the De Fi ecosystem.

Regular Audits and Assessments

To ensure that your KYC/AML compliance program is effective, it's important to conduct regular audits and assessments. This involves reviewing your policies and procedures, testing your controls, and identifying areas for improvement. Regular audits can help you identify gaps in your compliance program and ensure that you are meeting all regulatory requirements. Furthermore, they can provide valuable insights into the effectiveness of your KYC/AML procedures.

Audits should be conducted by independent third parties to ensure objectivity. The results of the audits should be shared with management and used to improve your KYC/AML compliance program. Regular audits and assessments are a critical component of a robust KYC/AML compliance program. They help to ensure that your program is effective in preventing illicit activity and that you are meeting all regulatory requirements.

Fun Facts about KYC/AML and Smart Contracts

Did you know that the first documented case of money laundering dates back to the 1920s? It involved Al Capone and his attempts to conceal the proceeds of his illegal activities through a network of laundromats. Fast forward to today, and the fight against money laundering has become increasingly sophisticated, with regulations like KYC/AML playing a critical role. While smart contracts offer exciting new possibilities for financial innovation, they also present new challenges for KYC/AML compliance. It's a constant game of cat and mouse, with regulators and law enforcement agencies working to stay one step ahead of criminals.

Another fun fact is that some De Fi projects have attempted to implement "decentralized KYC" solutions, which involve using blockchain technology to verify identities in a privacy-preserving manner. However, these solutions are still in their early stages of development and face significant challenges in terms of scalability and security. The quest for a truly decentralized and compliant KYC/AML solution remains an ongoing effort.

How to Implement KYC in Smart Contracts

Implementing KYC within smart contracts requires careful planning and execution. The process typically involves integrating a KYC provider's API into the smart contract or d App. When a user interacts with the smart contract, they are prompted to undergo a KYC check through the provider. If the user passes the KYC check, they are granted access to the smart contract's functionality. If they fail, they are denied access. This approach ensures that only verified users can participate in the smart contract's activities.

Another approach is to use KYC-aware tokens. These tokens are designed to be transferred only between verified users. When a user receives a KYC-aware token, their identity is verified and linked to the token. The token can then be used to access various d Apps and services that require KYC compliance. This approach simplifies the KYC process for users and allows them to reuse their verified identity across multiple platforms.

What If KYC/AML Fails in Smart Contracts?

The consequences of failing to implement effective KYC/AML measures in smart contracts can be severe. Projects that fail to comply with KYC/AML regulations may face legal penalties, including fines and even criminal charges. Furthermore, they may lose the trust of their users and damage their reputation. The reputational damage alone can be devastating, as it can be difficult to recover from the perception that a project is facilitating illicit activities.

In addition to legal and reputational risks, failing to implement KYC/AML measures can also expose projects to financial risks. If a project is used to launder money or finance terrorism, it may be subject to asset seizure and other enforcement actions. Therefore, it's essential to prioritize KYC/AML compliance and to implement robust measures to prevent illicit activity.

List of KYC/AML Challenges in Smart Contracts

Here's a quick rundown of the biggest hurdles in the world of KYC/AML and smart contracts:

- Data Privacy Concerns: Balancing the need for transparency with the protection of user data.

- Technical Complexity: Integrating KYC/AML procedures into immutable and decentralized systems.

- Lack of Standardized Regulations: Navigating the patchwork of different regulatory requirements across jurisdictions.

- Scalability and Efficiency: Implementing KYC/AML checks without creating bottlenecks or excessive costs.

- Ongoing Monitoring: Continuously monitoring transactions and adapting to new threats and regulations.

Question and Answer

Q: Why is KYC/AML compliance important in the context of smart contracts?

A: KYC/AML compliance is crucial for preventing illicit activities such as money laundering, terrorist financing, and fraud. It helps to ensure that smart contracts are not used for illegal purposes and that the De Fi ecosystem remains safe and secure.

Q: What are some of the technical challenges of implementing KYC/AML in smart contracts?

A: Some of the technical challenges include the immutability of smart contracts, the need for decentralized identity verification solutions, and the complexity of integrating KYC/AML checks into decentralized applications.

Q: How can De Fi projects balance the need for KYC/AML compliance with the principles of decentralization and privacy?

A: De Fi projects can use a combination of technologies and strategies to balance these competing interests, such as zero-knowledge proofs, KYC-aware tokens, and decentralized identity verification solutions.

Q: What is the role of regulators in the development of KYC/AML regulations for smart contracts?

A: Regulators play a critical role in providing clear and standardized regulations for KYC/AML compliance in the context of smart contracts. This helps to create a level playing field for businesses and to prevent illicit activities.

Conclusion of The Biggest Risks and Challenges in KYC and AML Compliance via Smart Contracts

The integration of KYC and AML compliance into smart contracts is a complex and evolving challenge. It requires a careful balance between innovation and regulation, privacy and transparency, and security and usability. While there are significant hurdles to overcome, the potential benefits of a compliant and secure De Fi ecosystem are immense. By addressing the risks and challenges outlined in this post, we can pave the way for a more sustainable and trustworthy future for decentralized finance.