Imagine a world where payments happen automatically, securely, and without the need for intermediaries. Sounds futuristic? It's closer than you think! Experts are buzzing about a technology that could revolutionize how we handle money: smart contracts for automated payments.

Businesses and individuals often grapple with delayed payments, high transaction fees, and the constant worry of fraud. The reliance on traditional systems can be cumbersome, involving lengthy processes and multiple parties, leading to inefficiencies and potential disputes.

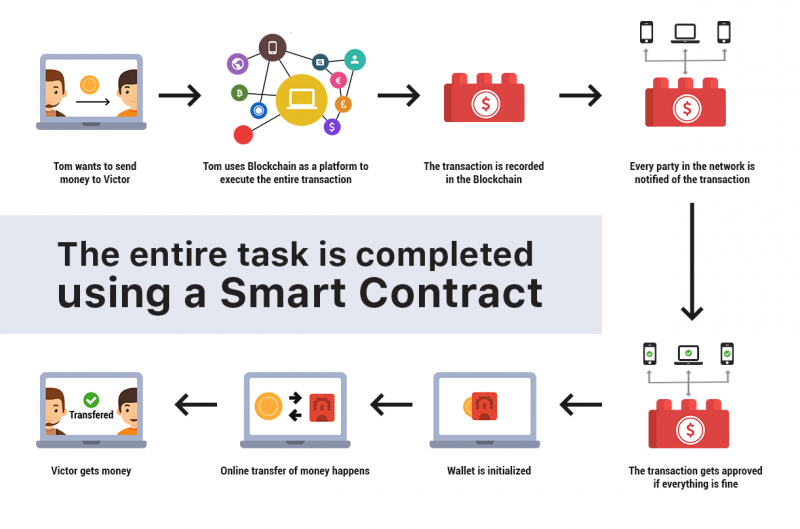

So, what exactly are the experts saying about using smart contracts for automated payments? They're largely optimistic, highlighting the potential for increased efficiency, transparency, and security. Smart contracts, self-executing agreements written in code and stored on a blockchain, can automate payment processes based on predefined conditions. This eliminates the need for intermediaries, reduces costs, and ensures that payments are made automatically once the agreed-upon conditions are met.

In essence, experts believe smart contracts offer a more reliable, transparent, and cost-effective way to manage payments. Keywords like blockchain, automation, decentralization, security, and efficiency are frequently mentioned in discussions surrounding this innovative technology. It is a transformative shift in how we think about and execute financial transactions.

The Benefits of Smart Contracts for Automated Payments

I remember a time when I was freelancing and constantly chasing clients for overdue invoices. The back-and-forth emails, the awkward phone calls – it was a real drain on my time and energy. If only smart contracts had been more widely adopted then! They could have automatically released payments upon completion of milestones, saving me countless hours and headaches. That personal experience really brought home the potential of this technology for me. Experts emphasize that smart contracts offer a multitude of benefits for automated payments, including reduced transaction costs. By eliminating intermediaries like banks and payment processors, smart contracts can significantly lower fees. Increased transparency is another key advantage. Because smart contracts are stored on a blockchain, all transactions are publicly verifiable, providing greater accountability and trust. Enhanced security is also a major draw. The cryptographic nature of blockchain technology makes smart contracts highly resistant to fraud and tampering. Faster payment processing is another benefit. Payments are executed automatically and instantly once the pre-defined conditions are met. This can dramatically improve cash flow for businesses and individuals. And ultimately, the potential for reduced disputes as all terms are coded for execution, ensuring there is little room for misinterpretation or argument.

Understanding Smart Contract Mechanics

At their core, smart contracts are self-executing agreements written in code and deployed on a blockchain. Imagine a vending machine: you insert money (the input), select your item (the condition), and the machine dispenses your snack (the output). A smart contract operates similarly. The "code" defines the terms and conditions of the agreement, such as "if X happens, then Y will be executed." This code is immutable and transparent, meaning it cannot be altered once deployed and is visible to all participants on the blockchain. What the experts say about smart contract mechanics often centers around their deterministic nature. The outcome of a smart contract is always predictable, provided the inputs are known. This predictability eliminates ambiguity and reduces the risk of disputes. Furthermore, smart contracts are decentralized, meaning they are not controlled by any single entity. This distributed nature makes them resistant to censorship and manipulation. Because the smart contracts are stored on a blockchain, they are secure. Finally, smart contracts are autonomous, which means that once they are deployed, they will run automatically. It helps to increase trust in your agreement, and can help you feel safe and in control.

History and Myths Surrounding Smart Contracts

The concept of smart contracts dates back to the 1990s, when computer scientist Nick Szabo first proposed the idea. However, it wasn't until the advent of blockchain technology, particularly the Ethereum platform, that smart contracts truly became feasible. One common myth is that smart contracts are entirely foolproof. While they offer enhanced security, they are still susceptible to coding errors or vulnerabilities that can be exploited. Experts emphasize that rigorous auditing and testing are crucial to mitigate these risks. Another myth is that smart contracts are only for complex financial transactions. In reality, they can be used for a wide range of applications, from supply chain management to digital identity verification. The history of smart contracts is intertwined with the evolution of blockchain technology. Bitcoin laid the groundwork for decentralized transactions, but Ethereum took it a step further by enabling the creation of programmable contracts. Today, various blockchain platforms support smart contracts, each with its own strengths and limitations. They continue to evolve and improve, and become more robust and versatile with time. The power of blockchain will never stop surprising people.

The Hidden Secrets of Smart Contract Security

While smart contracts offer significant security advantages, they are not immune to vulnerabilities. Experts warn that neglecting security best practices can lead to costly exploits. One hidden secret is that smart contract security is not just about the code itself. It also involves the infrastructure, the development tools, and the human element. Common vulnerabilities include reentrancy attacks, integer overflows, and denial-of-service attacks. Developers must be vigilant in identifying and mitigating these risks. Auditing is crucial for ensuring the security of smart contracts. Independent security firms can review the code and identify potential vulnerabilities before the contract is deployed. Formal verification is another technique that can be used to mathematically prove the correctness of a smart contract. The hidden secret lies in a multi-layered approach to security. It involves secure coding practices, thorough testing, independent audits, and ongoing monitoring. Furthermore, it's important to stay up-to-date on the latest security threats and best practices in the smart contract ecosystem. One of the worst things you can do is to bury your head in the sand and ignore all the ways you can improve the security of your code.

Recommendations for Implementing Smart Contracts

Experts recommend a phased approach to implementing smart contracts for automated payments. Start with small, low-risk projects to gain experience and build confidence. Choose a blockchain platform that aligns with your specific needs and technical capabilities. Consider factors like transaction fees, scalability, and developer support. Ensure that your smart contracts are thoroughly tested and audited before deployment. Engage with the community and learn from the experiences of others. Experts also recommend adopting a layered security approach. This involves implementing multiple layers of security controls to protect against various threats. These controls might include access control lists, rate limiting, and anomaly detection systems. It is essential to develop a plan to remediate vulnerabilities. This plan should include the steps you will take to address any vulnerabilities that are identified in your smart contracts. Recommendations extend to having a detailed governance plan in place. This plan should outline the roles and responsibilities of all parties involved in the smart contract implementation. Make sure that everyone is on the same page from the very beginning, and that everyone has the ability to ask questions if they are confused.

Key Considerations for Smart Contract Design

Designing effective smart contracts for automated payments requires careful consideration of several factors. Experts emphasize the importance of clear and unambiguous contract terms. The code should accurately reflect the intent of the parties involved. The code should also consider potential edge cases and error conditions. The contract should be designed to handle unexpected situations gracefully. Another key consideration is gas optimization. Smart contracts consume gas (a unit of computational effort) when executed on the blockchain. Optimizing the code to reduce gas consumption can significantly lower transaction costs. The smart contract should also be modular and reusable. This makes it easier to maintain and update the code over time. Modularity also promotes code reuse, which can save development time and effort. Additionally, your smart contracts should be designed to be upgradeable. This makes it possible to fix bugs and add new features without having to redeploy the entire contract. Overall, careful design is essential for creating secure, efficient, and reliable smart contracts for automated payments. It might seem as though there are a lot of considerations, but it is important to get all of your ducks in a row before you proceed.

Tips for Optimizing Smart Contract Performance

Experts offer several tips for optimizing smart contract performance, leading to faster and cheaper transactions. One key tip is to minimize on-chain storage. Storing data on the blockchain is expensive, so only store what is absolutely necessary. Use off-chain storage solutions for larger or less frequently accessed data. Another tip is to avoid loops and iterations. Loops can be computationally expensive and consume a lot of gas. Try to use more efficient data structures or algorithms. Experts also recommend caching frequently accessed data. This can reduce the number of times the smart contract needs to read from the blockchain. Also, keep it simple and easy to read. This makes it easier for others to understand your code, and can help you identify potential vulnerabilities. Furthermore, make sure that you test your code thoroughly. Test your smart contracts in a variety of environments to ensure that they are working correctly. All of the factors listed above will help you make your smart contracts as smooth and effective as possible. If you have any questions, make sure that you ask an expert to help you.

Best Practices for Auditing Smart Contracts

Auditing smart contracts is essential for identifying potential vulnerabilities and ensuring the security of your code. Experts recommend following a structured approach to auditing, starting with a thorough review of the contract specifications. Understand the intended functionality of the smart contract. Identify any potential security risks. Next, review the code line by line, looking for common vulnerabilities. Pay particular attention to areas that handle sensitive data or critical logic. Experts also recommend using automated tools to assist with the auditing process. These tools can help identify potential vulnerabilities more quickly and accurately. However, automated tools should not be used as a substitute for manual code review. Another best practice is to engage with independent security auditors. These auditors can provide an unbiased assessment of the smart contract's security. The auditor will provide you with a report of their findings and recommendations for remediation. Furthermore, your code should also be reviewed by other developers. A second set of eyes can often spot vulnerabilities that you may have missed. You can do this by inviting other developers to review your code and provide feedback. With all of the factors listed above, you can rest assured that your code is robust, secure, and ready to be deployed.

Fun Facts About Smart Contracts

Did you know that the first smart contract was created in 1994? Nick Szabo, the computer scientist who coined the term "smart contract," developed a virtual vending machine that executed its terms automatically. Another fun fact is that the DAO (Decentralized Autonomous Organization), one of the earliest and most ambitious smart contract projects, was hacked in 2016, resulting in the theft of millions of dollars worth of Ether. This event highlighted the importance of smart contract security. Experts also point out that smart contracts are not just for financial applications. They can be used for a wide range of purposes, from supply chain management to voting systems. Another fun fact is that some smart contracts are designed to be "unstoppable," meaning that they cannot be shut down or censored. These unstoppable contracts are often used for decentralized applications that require a high degree of censorship resistance. Smart contracts have a fascinating history and hold immense potential for the future.

How to Implement Smart Contracts for Payments

Implementing smart contracts for automated payments involves several steps. First, you need to choose a blockchain platform. Ethereum is the most popular platform for smart contracts, but other options include Solana, Cardano, and Polkadot. Next, you need to write the smart contract code. You can use a programming language like Solidity (for Ethereum) or Rust (for Solana). Experts recommend using a framework like Truffle or Hardhat to streamline the development process. Once you have written the code, you need to compile it and deploy it to the blockchain. This requires setting up a development environment and using a wallet to pay for the deployment costs. After the smart contract is deployed, you need to test it thoroughly. Use testnets (test networks) to simulate real-world conditions and identify any potential vulnerabilities. Finally, you need to integrate the smart contract with your application. This involves creating a user interface that allows users to interact with the smart contract. In addition, make sure to implement a good logging and debugging system.

What if Smart Contracts Fail?

The possibility of smart contract failure is a serious concern. Experts emphasize the importance of having a plan in place to address potential issues. One common cause of failure is coding errors or vulnerabilities. These can lead to unexpected behavior or even the loss of funds. Another cause of failure is external events, such as changes in regulations or market conditions. These events can render the smart contract invalid or unenforceable. What if a smart contract fails? Experts recommend having a contingency plan in place. This plan should outline the steps you will take to mitigate the damage and recover any lost funds. One option is to use a "kill switch" to disable the smart contract. However, this should only be used as a last resort, as it can have unintended consequences. Another option is to use a "circuit breaker" to limit the damage caused by a malfunctioning smart contract. The circuit breaker will automatically disable the smart contract if certain conditions are met. Ultimately, the best way to prevent smart contract failure is to implement robust security measures and conduct thorough testing. Regular code audits, formal verification, and ongoing monitoring can help to identify and mitigate potential risks.

Listicle of Smart Contract Use Cases for Payments

Here's a list of smart contract use cases for payments that experts are excited about: 1.Escrow Services: Smart contracts can act as neutral intermediaries in escrow agreements, releasing funds only when predefined conditions are met.

2.Subscription Payments: Automate recurring payments for subscription services, ensuring timely and reliable billing.

3.Supply Chain Finance: Streamline invoice payments and financing in supply chains, improving efficiency and reducing costs.

4.Payroll Automation: Automate payroll processes, ensuring that employees are paid on time and accurately.

5.Crowdfunding: Manage crowdfunding campaigns, ensuring that funds are released only when the project reaches its goals.

6.Decentralized Marketplaces: Facilitate secure and transparent transactions in decentralized marketplaces.

7.Real Estate Transactions: Automate the process of buying and selling real estate, reducing paperwork and transaction costs.

8.Insurance Claims: Automate the processing of insurance claims, speeding up payouts and reducing fraud.

9.Micro Payments: Enable small, frequent payments for content or services.

10.Gaming Rewards: Distribute rewards to players in blockchain-based games. These are just a few of the many potential applications of smart contracts for automated payments. As the technology matures, we can expect to see even more innovative use cases emerge.

Question and Answer About What Experts Say About Smart Contracts for Automated Payments

Here are some common questions and answers about experts say about smart contracts for automated payments:

Q: Are smart contracts truly secure?

A: While smart contracts offer enhanced security compared to traditional systems, they are not immune to vulnerabilities. Rigorous auditing and testing are essential.

Q: What are the benefits of using smart contracts for payments?

A: Experts highlight benefits like reduced transaction costs, increased transparency, enhanced security, and faster payment processing.

Q: Are smart contracts difficult to implement?

A: Implementing smart contracts requires technical expertise, but frameworks and tools are available to simplify the development process.

Q: What happens if a smart contract fails?

A: It's crucial to have a contingency plan in place to address potential failures, including coding errors or external events.

Conclusion of What Experts Say About Smart Contracts for Automated Payments

Experts generally agree that smart contracts hold immense promise for revolutionizing automated payments. By leveraging blockchain technology, these self-executing agreements can offer greater efficiency, transparency, and security. While challenges remain, such as security vulnerabilities and the need for technical expertise, the potential benefits are undeniable. As the technology matures and adoption increases, smart contracts are poised to transform how we manage financial transactions in the digital age. The keywords to keep in mind are efficiency, transparency, security, automation, and blockchain. Keep your eyes on the horizon as more innovation in this exciting field unfolds!