Imagine a world where verifying identities and preventing financial crime isn't a compliance burden, but a seamless, automated process. A world where trust is built directly into the digital fabric of transactions, minimizing risk and maximizing efficiency. That future is closer than you think, powered by the innovative application of smart contracts to Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance.

The current landscape of KYC and AML is often fraught with challenges. Businesses face mounting regulatory pressures, increasing costs associated with manual verification processes, and the constant threat of fraud. Data silos and a lack of interoperability between different systems make it difficult to gain a holistic view of customer risk, leading to inefficiencies and potential compliance gaps.

This article delves into how smart contracts are revolutionizing KYC and AML compliance. We'll explore how these self-executing agreements can automate identity verification, streamline transaction monitoring, and enhance data security. By leveraging the power of blockchain technology, businesses can achieve greater transparency, efficiency, and security in their compliance efforts.

In summary, this article explores the transformative potential of smart contracts in KYC and AML, highlighting their ability to automate processes, enhance data security, and improve transparency. We'll delve into practical applications, address common misconceptions, and provide actionable insights for businesses looking to leverage this innovative technology to streamline their compliance operations and reduce risk. Key concepts explored include blockchain, smart contracts, KYC, AML, regulatory compliance, data security, and process automation.

The Promise of Automated Identity Verification

The primary allure of smart contracts in KYC lies in their ability to automate identity verification. I remember one particular project where we were struggling to onboard new customers quickly enough. The manual KYC process was a significant bottleneck, often taking days to complete. We were losing potential customers due to the delays and facing increasing pressure from regulators to improve our compliance procedures. It felt like we were constantly playing catch-up, struggling to keep pace with the ever-evolving regulatory landscape.

Smart contracts offer a solution by providing a framework for decentralized identity management. Instead of relying on centralized databases that are vulnerable to breaches, individuals can securely store their verified identity information on a blockchain. When a business needs to verify a customer's identity, they can use a smart contract to access the customer's data with their explicit consent. This eliminates the need for manual verification processes, reduces the risk of fraud, and speeds up onboarding times. Furthermore, by leveraging decentralized identity solutions, individuals gain greater control over their personal data, promoting privacy and transparency.

The beauty of this approach is that once an identity is verified and recorded on the blockchain, it can be reused across multiple platforms and services. This eliminates the need for repeated KYC checks, saving time and resources for both businesses and customers. This also improves the overall user experience, making it easier for people to access the services they need without having to jump through multiple hoops. Smart contracts ensure that the verification process is secure, transparent, and compliant with relevant regulations. They provide an audit trail of all interactions, making it easier to track and monitor compliance efforts.

Streamlining Transaction Monitoring

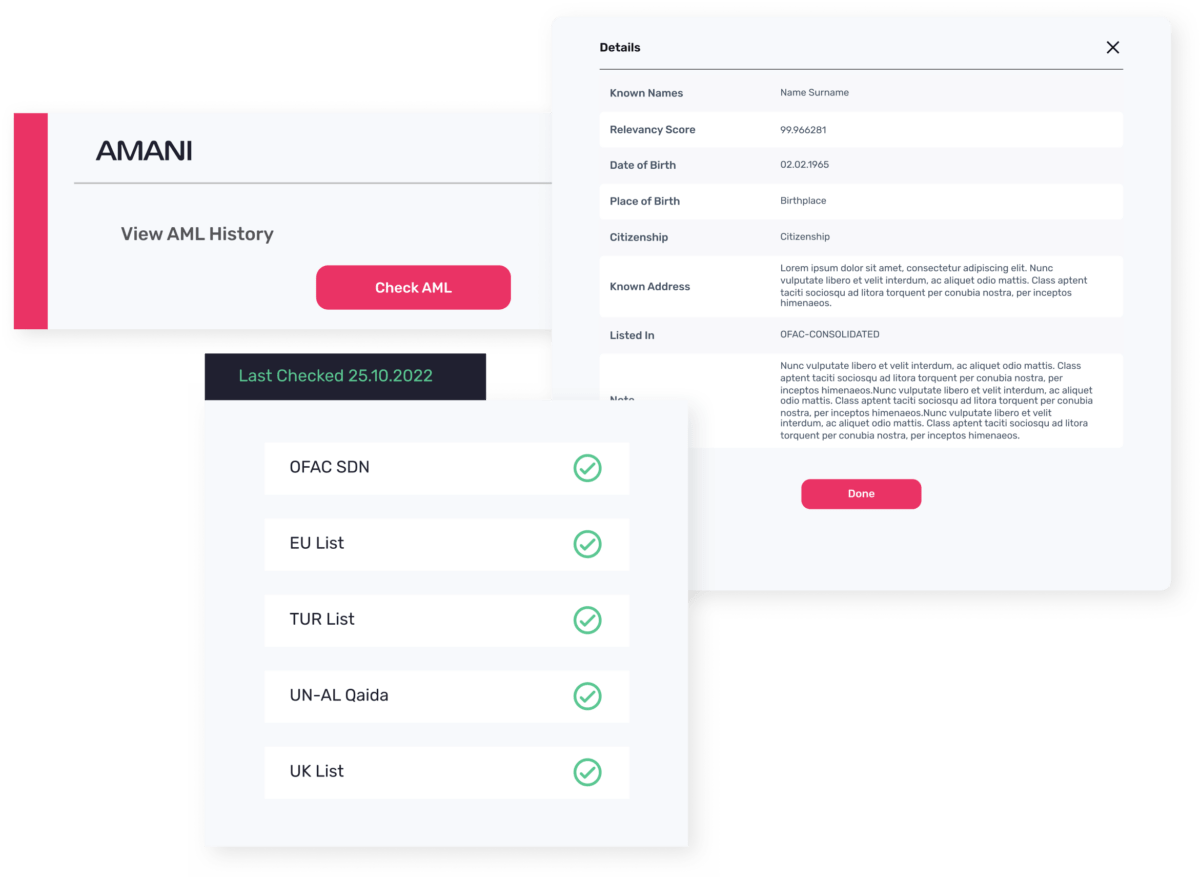

Beyond identity verification, smart contracts can also streamline transaction monitoring, a critical aspect of AML compliance. Traditional transaction monitoring systems often rely on rule-based algorithms that can generate a high number of false positives. This results in wasted resources and delays in identifying genuine instances of money laundering.

Smart contracts can improve transaction monitoring by automating the process of flagging suspicious transactions. By encoding specific AML rules into a smart contract, transactions can be automatically screened against these rules in real-time. If a transaction triggers any of the encoded rules, the smart contract can automatically flag it for further investigation. This reduces the burden on human analysts and allows them to focus on the most high-risk transactions. Furthermore, smart contracts can be used to create a shared database of suspicious transactions, allowing businesses to collaborate and share information in a secure and compliant manner. This improves the overall effectiveness of AML efforts and helps to prevent financial crime.

Another advantage of using smart contracts for transaction monitoring is that they can be easily updated to reflect changes in regulations. This ensures that businesses remain compliant with the latest AML requirements without having to undergo costly and time-consuming system upgrades. The transparent and immutable nature of blockchain technology also provides a clear audit trail of all transactions, making it easier to demonstrate compliance to regulators.

The History and Evolution of Smart Contracts in Compliance

The concept of smart contracts isn't new, dating back to the 1990s. However, it was the advent of blockchain technology, particularly Ethereum, that truly unlocked their potential. Initially, their application to KYC and AML was theoretical. It took time for the industry to grasp the possibilities and develop practical use cases.

The early days were marked by skepticism and concerns about regulatory uncertainty. Many questioned whether smart contracts could truly meet the stringent requirements of KYC and AML regulations. However, as blockchain technology matured and regulatory frameworks evolved, the adoption of smart contracts in compliance began to gain momentum. Pilot projects and proof-of-concepts demonstrated the potential benefits, including reduced costs, improved efficiency, and enhanced data security. This led to increased investment in research and development, paving the way for the development of more sophisticated and robust smart contract solutions.

The myth that smart contracts are inherently complex and difficult to implement has also been dispelled. While developing and deploying smart contracts requires technical expertise, there are now user-friendly platforms and tools that make it easier for businesses to integrate them into their existing compliance workflows. The increasing availability of skilled developers and consultants has also contributed to the growing adoption of smart contracts in KYC and AML. Today, smart contracts are being used by a wide range of financial institutions and other businesses to streamline their compliance operations and reduce the risk of financial crime.

Unveiling the Hidden Secret: Data Privacy and Security

One of the often-overlooked benefits of using smart contracts for KYC and AML is the enhanced data privacy and security they provide. Traditional KYC and AML processes often involve the collection and storage of sensitive personal data in centralized databases, which are vulnerable to breaches and unauthorized access.

Smart contracts, on the other hand, can be used to implement privacy-preserving techniques that protect customer data while still enabling compliance. For example, zero-knowledge proofs can be used to verify customer information without revealing the underlying data. This allows businesses to comply with KYC and AML regulations without compromising customer privacy. Furthermore, the decentralized nature of blockchain technology makes it more difficult for hackers to target and compromise customer data. By distributing data across multiple nodes, the risk of a single point of failure is eliminated, making it more resilient to attacks. This enhanced security and privacy can build trust with customers and improve the overall reputation of the business.

The use of smart contracts also promotes data transparency and accountability. All interactions with the smart contract are recorded on the blockchain, providing a clear audit trail of all data processing activities. This makes it easier to track and monitor compliance efforts and demonstrate compliance to regulators. The immutable nature of blockchain technology also ensures that data cannot be tampered with or altered, further enhancing its integrity and reliability.

Recommendations for Implementing Smart Contracts in KYC/AML

If you're considering implementing smart contracts in your KYC and AML processes, here are a few recommendations to keep in mind. Firstly, it's crucial to start with a clear understanding of your existing compliance requirements. Identify the specific areas where smart contracts can provide the most value and focus your efforts on those areas.

Secondly, choose the right platform and tools for your needs. There are several blockchain platforms that support smart contract development, each with its own strengths and weaknesses. Consider factors such as scalability, security, and ease of use when making your decision. You'll also need to select the appropriate development tools and libraries to build and deploy your smart contracts. Thirdly, ensure that your smart contracts are thoroughly tested and audited before deploying them to a live environment. This will help to identify and address any potential vulnerabilities or bugs that could compromise the security or functionality of your smart contracts. Finally, stay informed about the evolving regulatory landscape and adapt your smart contracts accordingly. KYC and AML regulations are constantly changing, so it's important to ensure that your smart contracts remain compliant with the latest requirements.

By following these recommendations, you can successfully implement smart contracts in your KYC and AML processes and reap the benefits of increased efficiency, enhanced data security, and improved transparency.

The Importance of Regulatory Compliance

It's vital to remember that even with the power of smart contracts, regulatory compliance remains paramount. These aren't a magic bullet to bypass regulations, but a tool to enhance compliance efforts. Ignoring this aspect can lead to serious legal and financial repercussions. Smart contracts must be designed and implemented in a way that adheres to all applicable KYC and AML regulations. This includes ensuring that customer data is protected, that transactions are properly monitored, and that suspicious activity is reported to the relevant authorities.

Furthermore, it's important to work closely with regulators to ensure that your smart contract solutions are compliant with their requirements. This may involve seeking regulatory approval for your smart contracts or participating in pilot programs to demonstrate their effectiveness. By engaging with regulators early and often, you can build trust and confidence in your smart contract solutions and avoid potential compliance issues down the road. The regulatory landscape for blockchain and smart contracts is still evolving, so it's important to stay informed about the latest developments and adapt your compliance strategies accordingly.

Ultimately, the goal is to use smart contracts to create a more efficient, transparent, and secure KYC and AML ecosystem that benefits both businesses and customers. By embracing innovation while remaining committed to regulatory compliance, we can unlock the full potential of smart contracts in the fight against financial crime.

Tips for Successful Implementation

Successful implementation of smart contracts in KYC and AML requires careful planning and execution. Here are a few tips to help you get started: First, start small and focus on a specific use case. Don't try to implement smart contracts across your entire compliance operation at once. Instead, identify a specific area where smart contracts can provide the most value and focus your efforts on that area.

Second, build a strong team with the necessary expertise. Implementing smart contracts requires a team with expertise in blockchain technology, smart contract development, and regulatory compliance. If you don't have these skills in-house, consider partnering with a consultant or vendor who can provide the necessary expertise. Third, prioritize data security and privacy. Smart contracts should be designed and implemented in a way that protects customer data and complies with all applicable privacy regulations. This may involve using privacy-preserving techniques such as zero-knowledge proofs or homomorphic encryption.

Finally, monitor and evaluate the performance of your smart contracts on an ongoing basis. Track key metrics such as transaction processing times, compliance costs, and the number of suspicious transactions flagged. This will help you to identify areas for improvement and ensure that your smart contracts are delivering the expected benefits. By following these tips, you can increase your chances of successfully implementing smart contracts in your KYC and AML processes.

Addressing Common Misconceptions

One common misconception is that smart contracts are a "set it and forget it" solution. In reality, they require ongoing monitoring, maintenance, and updates to ensure they remain effective and compliant. Regulations change, fraud techniques evolve, and technology advances, all requiring adjustments to the smart contract logic.

Another misconception is that smart contracts are inherently secure. While blockchain technology is inherently secure, smart contracts themselves can be vulnerable to bugs and exploits if they are not properly designed and tested. It's crucial to conduct thorough security audits of your smart contracts before deploying them to a live environment. Furthermore, it's important to implement robust monitoring and alerting systems to detect and respond to any potential security incidents. The security of your smart contracts is only as good as the people and processes that support them. Therefore, it's essential to invest in training and development to ensure that your team has the skills and knowledge necessary to maintain the security of your smart contracts.

Finally, some believe that smart contracts will completely replace human involvement in KYC and AML. While smart contracts can automate many aspects of compliance, human judgment and expertise will still be needed to handle complex cases and make decisions that require nuanced understanding. The ideal approach is to combine the power of smart contracts with the knowledge and experience of human experts to create a more effective and efficient compliance process.

Fun Facts About Smart Contracts

Did you know that the term "smart contract" was coined by Nick Szabo in 1994, long before the advent of blockchain? He envisioned a future where contracts could be embedded in hardware and software to automate and enforce agreements. However, it wasn't until the emergence of blockchain technology that smart contracts truly became a reality.

Another fun fact is that the first smart contract platform, Ethereum, was created by Vitalik Buterin, a then 19-year-old programmer. He envisioned a platform that would allow developers to build decentralized applications (d Apps) and smart contracts without the need for a central authority. Ethereum quickly gained popularity and has become the leading platform for smart contract development. Today, thousands of d Apps and smart contracts are running on the Ethereum blockchain, powering a wide range of applications, from decentralized finance (De Fi) to supply chain management.

Smart contracts are also being used in some unexpected ways, such as in voting systems to ensure transparency and prevent fraud, and in art to create unique digital collectibles known as Non-Fungible Tokens (NFTs). The possibilities for smart contracts are endless, and we are only just beginning to explore their full potential. As blockchain technology continues to evolve, we can expect to see even more innovative and creative applications of smart contracts in the future.

How to Get Started with Smart Contracts for KYC/AML

If you're ready to explore the potential of smart contracts for your KYC/AML compliance, here's a step-by-step guide to help you get started: 1. Educate yourself and your team about blockchain technology and smart contracts. There are numerous online resources, courses, and workshops that can help you learn the basics of blockchain and smart contracts.

2. Identify specific use cases where smart contracts can provide the most value. Consider areas such as identity verification, transaction monitoring, and fraud detection.

3. Choose a suitable blockchain platform and development tools. Research different blockchain platforms such as Ethereum, Hyperledger Fabric, and Corda, and select the one that best fits your needs.

4. Design and develop your smart contracts. Work with experienced smart contract developers to design and develop your smart contracts, ensuring that they are secure, efficient, and compliant with relevant regulations.

5. Test and audit your smart contracts. Thoroughly test and audit your smart contracts before deploying them to a live environment. Engage with a reputable security auditing firm to identify and address any potential vulnerabilities.

6. Integrate your smart contracts with your existing systems. Integrate your smart contracts with your existing KYC/AML systems to streamline your compliance processes.

7. Monitor and evaluate the performance of your smart contracts. Track key metrics such as transaction processing times, compliance costs, and the number of suspicious transactions flagged.

8. Stay informed about the evolving regulatory landscape. Continuously monitor changes in KYC/AML regulations and adapt your smart contracts accordingly.

By following these steps, you can successfully implement smart contracts in your KYC/AML processes and unlock the benefits of increased efficiency, enhanced data security, and improved transparency.

What If Smart Contracts Fail?

The possibility of smart contract failure is a valid concern. What happens if there's a bug in the code that leads to unintended consequences? Or if the contract is exploited by a malicious actor? These scenarios highlight the importance of rigorous testing and auditing before deployment.

Even with thorough testing, there's always a risk of unforeseen vulnerabilities. In such cases, it's crucial to have a contingency plan in place. This might involve halting the execution of the contract, rolling back to a previous version, or implementing a "kill switch" to terminate the contract altogether. The specific response will depend on the nature of the failure and the impact it's having on users. Furthermore, it's important to have clear legal agreements in place that address the potential liabilities and responsibilities associated with smart contract failures. This can help to protect both businesses and users in the event of an unexpected issue.

One way to mitigate the risk of smart contract failure is to use formal verification techniques. Formal verification involves mathematically proving that a smart contract meets its specifications. This can help to identify and eliminate bugs and vulnerabilities before they can be exploited. While formal verification can be a complex and time-consuming process, it can significantly reduce the risk of smart contract failure and increase confidence in the reliability of your smart contract solutions.

Listicle: Top 5 Benefits of Smart Contracts for KYC/AML

Here's a quick rundown of the top 5 benefits of using smart contracts in KYC and AML compliance:

- Increased Efficiency: Automate manual processes, reduce paperwork, and speed up onboarding times.

- Enhanced Data Security: Protect customer data with blockchain's inherent security features and privacy-preserving techniques.

- Improved Transparency: Create a transparent and auditable record of all compliance activities.

- Reduced Costs: Lower compliance costs by automating processes and reducing the need for manual labor.

- Greater Accuracy: Minimize errors and reduce the risk of fraud by automating decision-making based on pre-defined rules.

These benefits highlight the transformative potential of smart contracts in KYC and AML. By embracing this innovative technology, businesses can streamline their compliance operations, reduce risk, and improve the overall customer experience. As the regulatory landscape continues to evolve, smart contracts are poised to play an increasingly important role in the fight against financial crime.

Question and Answer

Here are some frequently asked questions about smart contracts and their application to KYC/AML:

Q: Are smart contracts legally binding?

A: The legal status of smart contracts is still evolving, but in many jurisdictions, they are considered legally binding agreements, provided they meet certain requirements such as offer, acceptance, and consideration.

Q: How can I ensure my smart contracts are compliant with regulations?

A: Work with legal experts to ensure your smart contracts are designed to comply with all applicable regulations. Conduct regular audits and stay informed about regulatory changes.

Q: What are the challenges of implementing smart contracts for KYC/AML?

A: Challenges include regulatory uncertainty, scalability issues, and the need for specialized technical expertise.

Q: What types of businesses can benefit from using smart contracts for KYC/AML?

A: A wide range of businesses can benefit, including financial institutions, cryptocurrency exchanges, online marketplaces, and any other business that is subject to KYC/AML regulations.

Conclusion of Unlocking the Power of KYC and AML Compliance via Smart Contracts

The integration of smart contracts into KYC and AML processes represents a paradigm shift, offering a compelling vision for the future of compliance. While challenges remain, the potential benefits – increased efficiency, enhanced security, and improved transparency – are undeniable. By embracing this technology thoughtfully and strategically, businesses can not only meet their regulatory obligations more effectively but also gain a competitive advantage in an increasingly complex and demanding world.