Imagine owning a piece of a luxury apartment building in Paris, or a stake in a thriving commercial property in New York City, all without the hassle of traditional real estate investments. Sounds like a dream? Well, wake up! Tokenized real estate is making that dream a reality, and it's poised to reshape the entire landscape of property investment as we know it.

For years, the world of real estate has been largely inaccessible to the average investor. High entry costs, complex legal processes, and geographical limitations have created significant barriers. Many have felt excluded from participating in potentially lucrative opportunities, watching as institutions and high-net-worth individuals reap the benefits.

Tokenized real estate aims to democratize property investment by fractionalizing ownership into digital tokens. These tokens, representing a share of a property, can be bought, sold, and traded much like stocks or cryptocurrencies. This opens up real estate investing to a much wider audience, breaking down those long-standing barriers and paving the way for greater inclusivity.

Tokenization is revolutionizing real estate by making it more accessible, liquid, and transparent. By fractionalizing property ownership into digital tokens, investors can participate with smaller capital outlays, diversify their portfolios more easily, and benefit from increased liquidity through secondary markets. This innovative approach also enhances transparency through blockchain technology, streamlining processes and reducing intermediaries. Ultimately, tokenized real estate is empowering a broader range of investors to access previously unattainable opportunities in the property market.

Accessibility and Affordability

I remember when I first heard about tokenized real estate. I was at a tech conference, and the concept seemed so futuristic and almost too good to be true. As someone who had always been interested in real estate investing but felt priced out of the market, the idea of owning a fraction of a property for a relatively small amount was incredibly appealing. It felt like a game-changer, a way to finally participate in a market that had previously been reserved for the wealthy.

This accessibility is a key driver behind the growing popularity of tokenized real estate. By lowering the barrier to entry, it allows smaller investors to diversify their portfolios and participate in opportunities that were previously out of reach. Imagine being able to invest in a portfolio of properties across the globe with just a few hundred dollars. This is the power of tokenization. Beyond mere accessibility, it promotes affordability by allowing investors to tailor their investments to their budgets. The possibility of owning a piece of prime real estate in a bustling metropolis, without needing to secure a large mortgage or manage the property directly, is now a tangible reality.

Liquidity and Trading

One of the most significant advantages of tokenized real estate is the increased liquidity it offers. Traditionally, real estate investments have been notoriously illiquid. Selling a property can take months, or even years, and involves significant transaction costs. Tokenization changes this by allowing property owners to sell their tokens on secondary markets, much like stocks or cryptocurrencies. This means that investors can quickly and easily convert their real estate holdings into cash, without the hassle of traditional property sales.

The ability to trade real estate tokens also opens up new possibilities for investors. They can now actively manage their portfolios, buying and selling tokens based on market conditions and their investment goals. This increased liquidity also attracts more investors to the market, as they know that they can easily exit their positions if needed. The emergence of dedicated platforms for trading these tokens is further fueling this trend, creating a vibrant and dynamic ecosystem for real estate investment.

Transparency and Security

The blockchain technology that underpins tokenized real estate provides a level of transparency and security that is simply not possible with traditional real estate transactions. Every transaction is recorded on a public ledger, making it easy to track ownership and verify the authenticity of the tokens. This eliminates the need for intermediaries, such as notaries and title companies, reducing transaction costs and streamlining the process.

Furthermore, blockchain technology ensures the security of the tokens and prevents fraud. The use of cryptography and distributed ledgers makes it extremely difficult for hackers to tamper with the system or counterfeit tokens. This increased transparency and security builds trust in the market and encourages more investors to participate. The inherent transparency of blockchain technology not only fosters trust but also enhances efficiency. Smart contracts, self-executing agreements written into the blockchain, automate many of the processes involved in real estate transactions, further reducing costs and delays.

Global Investment Opportunities

Tokenized real estate opens up a world of global investment opportunities that were previously inaccessible to most investors. You can now invest in properties in different countries without having to deal with the complexities of international real estate transactions. This diversification can help to reduce risk and improve returns.

Imagine investing in a luxury resort in the Caribbean, a commercial building in Asia, or a residential property in Europe, all from the comfort of your own home. Tokenization makes this possible by removing geographical barriers and simplifying the investment process. It also allows developers to tap into a global pool of investors, making it easier for them to raise capital for their projects. This globalization of real estate investment is transforming the market and creating new opportunities for both investors and developers.

How does Tokenized Real Estate Work?

Tokenized real estate works by representing ownership rights in a property as digital tokens on a blockchain. Think of it like slicing a pie into many small pieces. Each token represents a fraction of ownership in the underlying property. These tokens can then be bought, sold, and traded on specialized exchanges or platforms, similar to how stocks are traded on the stock market.

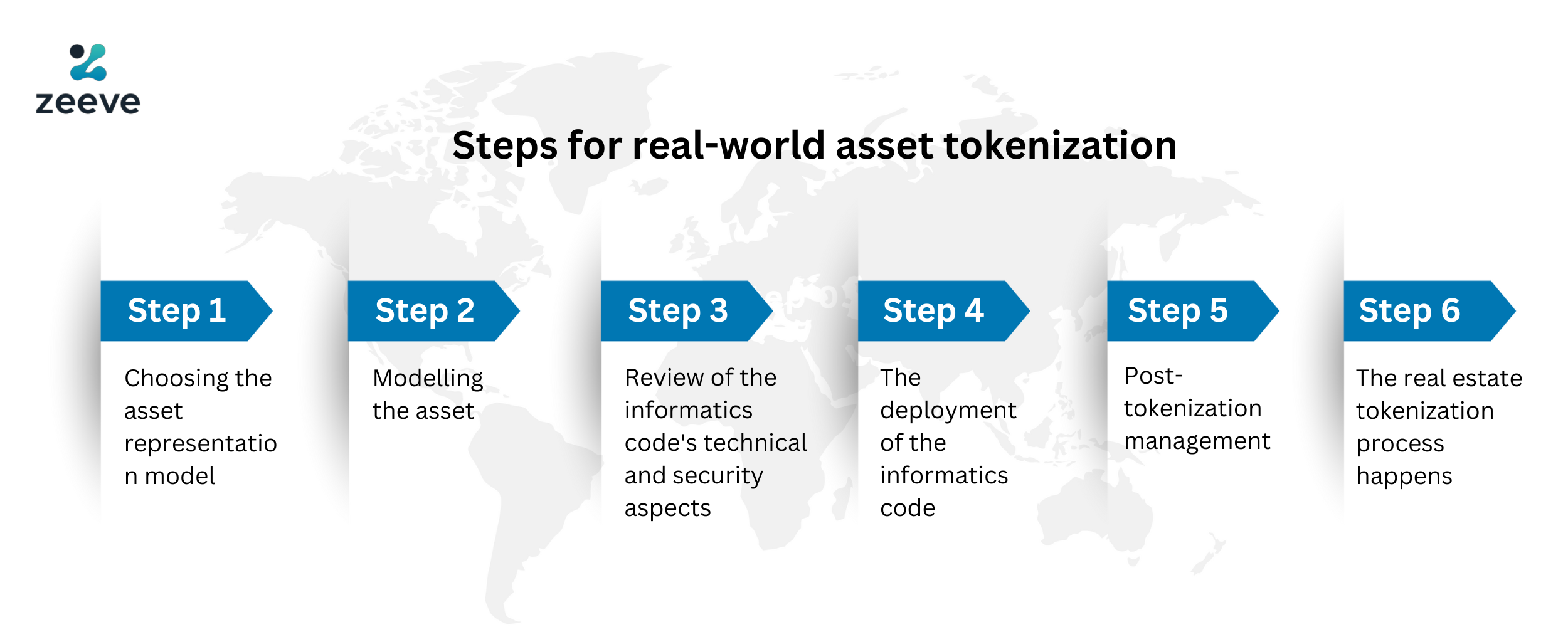

The process typically involves a real estate company or a developer creating tokens that represent ownership in a specific property. The value of each token is tied to the value of the underlying asset. Once the tokens are created, they are offered to investors through a security token offering (STO). Investors can then purchase these tokens using cryptocurrency or traditional fiat currency. The smart contracts on the blockchain automate many of the processes involved in real estate transactions, such as distributing rental income to token holders and managing voting rights.

Tokenization offers a transparent and efficient way to manage real estate assets, while also providing investors with greater liquidity and access to global markets.

Tips for Investing in Tokenized Real Estate

Before diving into the world of tokenized real estate, it's essential to do your research and understand the risks involved. Here are a few tips to help you get started: Research the platform: Choose a reputable platform that is regulated and has a track record of success. Look for platforms that offer due diligence on the properties they list and have a strong security infrastructure. Understand the property: Before investing in a property, carefully review the offering documents and understand the risks and potential rewards. Consider factors such as the property's location, occupancy rate, and potential for appreciation. Diversify your portfolio: Don't put all your eggs in one basket. Diversify your investments across multiple properties and platforms to reduce risk. Start small: Begin with a small investment to test the waters and get comfortable with the process. You can always increase your investment later if you are satisfied with the results. *Consult with a financial advisor: If you are unsure about whether tokenized real estate is right for you, consult with a financial advisor who can help you assess your risk tolerance and investment goals.

By following these tips, you can increase your chances of success in the exciting world of tokenized real estate.

Understanding Security Token Offerings (STOs)

Security Token Offerings (STOs) are the primary method for issuing tokenized real estate. Unlike Initial Coin Offerings (ICOs), which often involve unregulated utility tokens, STOs are subject to securities regulations. This means that companies offering security tokens must comply with securities laws, such as registering with the Securities and Exchange Commission (SEC) in the United States.

The regulatory oversight of STOs provides investors with greater protection and transparency. Companies are required to disclose detailed information about their business, financial condition, and the underlying assets backing the tokens. This allows investors to make more informed decisions. The compliance aspect may make it seem like a rigid process, but it brings in an element of trust and safety. Investors can rest assured that the tokens are backed by real assets and that the offering is being conducted in a legally compliant manner. STOs are bridging the gap between traditional finance and the world of blockchain, offering a regulated and secure way to invest in alternative assets like real estate.

Fun Facts about Tokenized Real Estate

Did you know that the first tokenized real estate project was launched in 2017? This marked a significant milestone in the industry and paved the way for the growth of tokenized real estate. Here are some other fun facts:

Some tokenized real estate projects offer dividends in cryptocurrency, providing investors with a passive income stream.

Tokenization can reduce the cost of real estate transactions by up to 80% by eliminating intermediaries and streamlining the process.

The global tokenized real estate market is projected to reach trillions of dollars in the coming years, making it one of the fastest-growing sectors in the blockchain industry.

Some platforms are experimenting with using blockchain technology to create decentralized autonomous organizations (DAOs) to manage tokenized real estate properties, allowing token holders to vote on important decisions.

These fun facts highlight the potential of tokenized real estate to transform the industry and create new opportunities for investors and developers alike. It is an exciting space to watch, and the potential applications are vast and innovative.

How to Get Started with Tokenized Real Estate

Getting started with tokenized real estate is easier than you might think. Here's a step-by-step guide:

1.Research platforms: Identify reputable platforms that offer tokenized real estate investments. Look for platforms that are regulated and have a good track record.

2.Create an account: Sign up for an account on your chosen platform and complete the necessary KYC (Know Your Customer) and AML (Anti-Money Laundering) verification processes.

3.Fund your account: Deposit funds into your account using cryptocurrency or fiat currency, depending on the platform's requirements.

4.Browse available properties: Explore the available properties and review the offering documents carefully.

5.Invest: Choose the properties you want to invest in and purchase the corresponding tokens.

6.Manage your portfolio: Monitor your investments and track your returns. You can also trade your tokens on secondary markets if desired.

With a little bit of research and planning, you can easily get started with tokenized real estate and participate in this exciting new asset class.

What if Tokenized Real Estate Becomes Mainstream?

Imagine a world where tokenized real estate is the norm. This would have profound implications for the industry and for investors. Here are some potential scenarios: Increased liquidity: Real estate would become much more liquid, allowing investors to quickly and easily buy and sell their holdings. Greater accessibility: Real estate investment would become accessible to a wider range of investors, regardless of their wealth or location. Lower transaction costs: The cost of real estate transactions would be significantly reduced, making it more affordable to invest in property. Greater transparency: Real estate transactions would be more transparent, reducing the risk of fraud and corruption. *New investment opportunities: Tokenization would create new investment opportunities, such as fractional ownership of high-value properties and the ability to invest in real estate projects around the world.

If tokenized real estate becomes mainstream, it could revolutionize the industry and create a more efficient, transparent, and accessible market for everyone. The ripple effect could positively influence not just finance but also urban development and property management.

Listicle: Top Benefits of Tokenized Real Estate

Here's a quick list of the top benefits of tokenized real estate:

1.Increased accessibility: Lower barrier to entry for investors.

2.Greater liquidity: Easier to buy and sell real estate.

3.Reduced transaction costs: Lower fees and commissions.

4.Enhanced transparency: Improved trust and security.

5.Global investment opportunities: Access to properties worldwide.

6.Portfolio diversification: Ability to invest in a variety of properties.

7.Passive income potential: Opportunity to earn dividends from rental income.

8.Faster transactions: Streamlined processes and reduced paperwork.

9.Fractional ownership: Ability to own a piece of high-value properties.

10.Democratization of real estate: Empowering a broader range of investors.

Tokenized real estate is truly transforming the real estate landscape, and these benefits are just the beginning.

Question and Answer about How Tokenized Real Estate Is Changing the World

Q: What are the main benefits of tokenizing real estate?*

A: The main benefits include increased accessibility, greater liquidity, reduced transaction costs, enhanced transparency, and access to global investment opportunities.

Q: How does tokenization make real estate more accessible?*

A: Tokenization lowers the barrier to entry by allowing investors to purchase fractional ownership in properties with smaller capital outlays. It also eliminates geographical limitations, making it easier to invest in properties around the world.

Q: What risks are associated with investing in tokenized real estate?*

A: As with any investment, there are risks involved. These include market volatility, regulatory uncertainty, and the potential for fraud. It's important to do your research and invest in reputable platforms.

Q: Is tokenized real estate regulated?*

A: The regulatory landscape for tokenized real estate is still evolving. In many jurisdictions, security token offerings (STOs) are subject to securities regulations. It's important to choose platforms that comply with these regulations to ensure investor protection.

Conclusion of How Tokenized Real Estate Is Changing the World

Tokenized real estate represents a paradigm shift in how we invest in property. By leveraging blockchain technology, it's breaking down barriers, increasing liquidity, and democratizing access to a market that has historically been exclusive. While still in its early stages, the potential of tokenized real estate to transform the industry is undeniable. As the technology matures and regulations become clearer, we can expect to see even greater adoption and innovation in this exciting new frontier.