Ever feel like navigating the world of crypto is like trying to decipher ancient hieroglyphics? You're not alone. Many are drawn to the potential of decentralized finance (De Fi), but quickly get lost in the technical jargon. One concept that often trips people up is Automated Market Makers (AMMs). But fear not, this guide is here to demystify AMMs and show you how to leverage them for maximum benefit.

Let's be honest, jumping into the De Fi space can feel daunting. You might be worried about losing money due to volatile markets, unsure where to find the best opportunities, or just plain confused by the complex mechanics of these platforms. It's easy to feel like you're missing out, but also hesitant to take the plunge without a clear understanding.

This article is your comprehensive guide to understanding and utilizing Automated Market Makers (AMMs) effectively. We'll break down the complexities, explore strategies for maximizing your returns, and equip you with the knowledge to confidently navigate the world of decentralized exchanges. Whether you're looking to provide liquidity, swap tokens, or simply understand how AMMs work, this guide has you covered.

This guide has unpacked the world of Automated Market Makers (AMMs), showing you how to move from a curious observer to an active participant. We've explored strategies for maximizing your returns, considered the risks involved, and provided practical tips for navigating the De Fi landscape. Remember, informed participation is key to unlocking the potential of AMMs and reaping the benefits of this revolutionary technology. The key words are Automated Market Makers (AMMs) and Decentralized Finance (De Fi).

Understanding Liquidity Pools

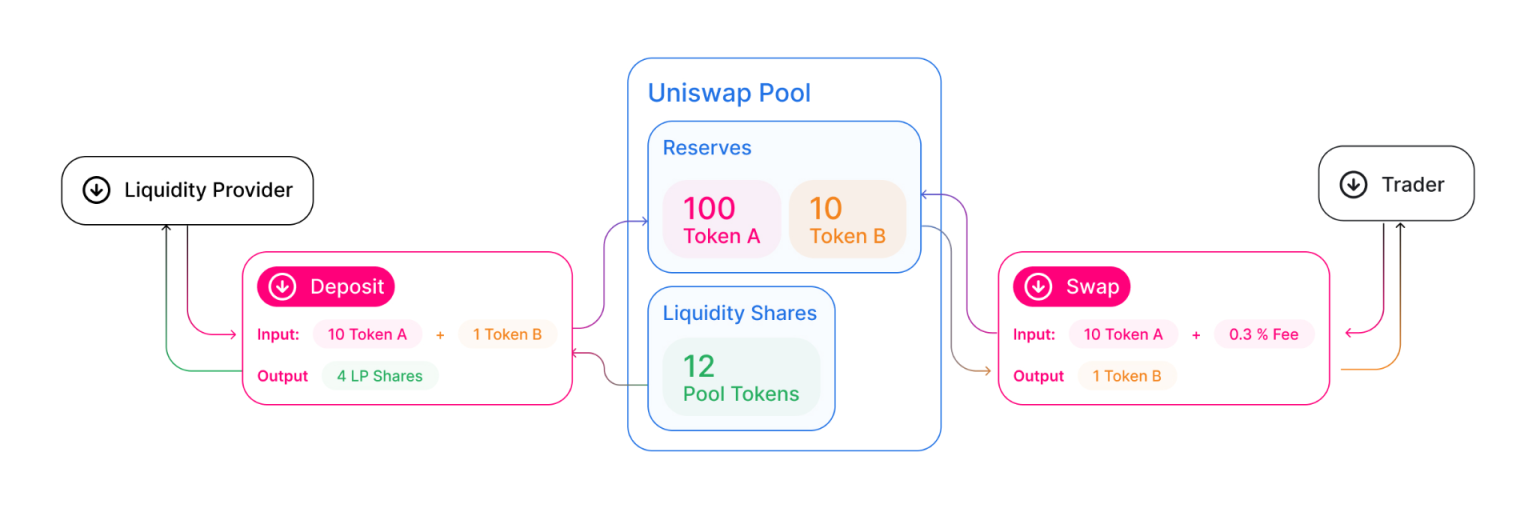

The target of this section is to help you understand the engine that drives AMMs: liquidity pools. I remember the first time I heard the term "liquidity pool." It sounded like some mystical, bottomless reservoir of crypto riches. In reality, it's a much simpler concept. Think of it as a digital piggy bank filled with tokens that traders can swap. These pools are funded by users like you and me, who deposit their tokens and earn a portion of the trading fees in return.

The magic happens because these pools are always available, 24/7, for anyone to trade against. There's no need to wait for a buyer or seller to appear. The price is determined by an algorithm that balances the ratio of tokens within the pool. So, if someone buys a lot of Token A, the price of Token A goes up, and the price of Token B (the other token in the pool) goes down. Understanding this simple mechanism is crucial for navigating the AMM landscape. This relates to Automated Market Makers (AMMs) by detailing the fundamental structure that makes AMMs functional, highlighting the roles of liquidity providers and the algorithmic price discovery mechanism. This understanding is vital for maximizing benefits, as it informs decisions on which pools to participate in and how to manage risk associated with providing liquidity.

Navigating Impermanent Loss

Impermanent Loss is a term that strikes fear into the hearts of many liquidity providers. But don't let the name scare you! The target of this section is to help you understand what Impermanent Loss is, how it works, and how to mitigate its effects. Impermanent Loss happens when the price of the tokens in your liquidity pool diverge from the price when you initially deposited them. The bigger the divergence, the bigger the potential loss. It's called "impermanent" because the loss isn't realized until you withdraw your tokens from the pool.

Think of it like this: You deposit $100 worth of Token A and $100 worth of Token B into a pool. Later, Token A's price doubles, while Token B stays the same. The AMM will rebalance the pool to maintain the 50/50 ratio, meaning you'll have fewer of Token A and more of Token B. While the total value of your tokens might still be around $200, you would have been better off just holding onto your original tokens. The key is to choose pools with stable assets or assets that tend to move in similar directions to minimize impermanent loss. This ties into using Automated Market Makers (AMMs) for maximum benefits because understanding and managing Impermanent Loss is crucial for profitability. By grasping the mechanics behind it, users can strategically select liquidity pools with lower risk profiles and implement strategies to mitigate potential losses, ultimately maximizing their returns.

Choosing the Right AMM Platform

With a plethora of AMM platforms available, choosing the right one can feel overwhelming. The target of this section is to provide you with a framework for evaluating different AMM platforms and selecting the one that best suits your needs. Not all AMMs are created equal. They differ in terms of fees, supported tokens, security, and overall user experience.

Some platforms, like Uniswap, are known for their simplicity and wide range of tokens. Others, like Curve, specialize in stablecoin swaps and offer lower slippage. When choosing a platform, consider factors like the tokens you want to trade, the fees you're willing to pay, and the level of security you require. Also, research the platform's reputation and community support. A platform with a strong community and active development is more likely to be reliable and innovative. The choice of AMM platform is integral to how to use Automated Market Makers (AMMs) for maximum benefits because each platform offers unique features, fee structures, and risk profiles. By carefully evaluating these factors, users can select a platform that aligns with their investment goals, risk tolerance, and trading preferences, thereby optimizing their potential returns and minimizing potential losses.

The History and Evolution of AMMs

The history of AMMs is a fascinating journey from theoretical concept to a cornerstone of the De Fi ecosystem. The target of this section is to provide you with a historical perspective on AMMs and their evolution, highlighting key milestones and innovations. The idea of automated market makers dates back to the early days of prediction markets, but it wasn't until the rise of Ethereum and smart contracts that AMMs truly took off.

Uniswap, launched in 2018, is widely considered the first successful AMM. It introduced the concept of constant product market makers and popularized the idea of permissionless trading. Since then, numerous other AMMs have emerged, each with its own unique features and innovations. Curve, for example, specializes in stablecoin swaps and uses a different algorithm to minimize slippage. Balancer allows users to create custom liquidity pools with multiple tokens. The evolution of AMMs is ongoing, with new platforms and features constantly being developed. Understanding this history helps you appreciate the potential of AMMs and anticipate future trends in the De Fi space. This sheds light on how to use Automated Market Makers (AMMs) for maximum benefits by providing context on their development and the factors driving their innovation. Understanding the historical evolution allows users to anticipate future trends, evaluate the maturity and reliability of different AMM platforms, and make informed decisions about which platforms and strategies are most likely to succeed.

Unlocking Hidden Secrets of AMM Strategies

Beyond the basics of providing liquidity and swapping tokens, there are more advanced strategies you can use to maximize your returns with AMMs. The target of this section is to reveal some of these hidden secrets and empower you to take your AMM game to the next level. One such strategy is yield farming, which involves moving your liquidity provider tokens to other platforms to earn additional rewards. For example, you might provide liquidity on Uniswap and then stake your UNI-V2 tokens on another platform to earn their native token.

Another strategy is to use leverage, which involves borrowing funds to increase your liquidity position. This can amplify your returns, but it also significantly increases your risk. It's crucial to understand the risks involved before using leverage. You can also use AMMs for arbitrage, which involves taking advantage of price differences between different exchanges. For example, if a token is trading for a higher price on one AMM than another, you can buy it on the cheaper exchange and sell it on the more expensive one, pocketing the difference. These advanced strategies can be highly profitable, but they also require a deeper understanding of AMM mechanics and market dynamics. This empowers users to use Automated Market Makers (AMMs) for maximum benefits by revealing sophisticated techniques for optimizing returns. By understanding these advanced strategies, users can move beyond basic liquidity provision and explore opportunities for yield farming, leverage, and arbitrage, potentially unlocking significantly higher profits. However, it also highlights the importance of due diligence and risk management when implementing these strategies.

Recommendations for AMM Participation

So, you're ready to dive into the world of AMMs? Great! But before you do, let's talk about some key recommendations to help you navigate the landscape and avoid common pitfalls. The target of this section is to provide you with practical advice and recommendations for successful AMM participation. First and foremost, do your research.

Don't just jump into the first pool you see. Understand the tokens involved, the potential risks, and the platform's reputation. Start small. Don't put all your eggs in one basket. Begin with a small amount of capital and gradually increase your position as you gain experience and confidence. Diversify your portfolio. Don't just invest in one AMM or one liquidity pool. Spread your investments across different platforms and assets to mitigate risk. Use stop-loss orders. If you're trading on an AMM, consider using stop-loss orders to limit your potential losses. Stay informed. Keep up-to-date with the latest news and developments in the De Fi space. The market is constantly evolving, and you need to stay informed to make sound investment decisions. These recommendations on how to use Automated Market Makers (AMMs) for maximum benefits stress the importance of diligent research, starting small, diversifying investments, using risk management tools, and staying informed about market trends. Following these recommendations can enhance the user's chances of success while minimizing potential losses in the often-volatile De Fi environment.

Risk Assessment and Mitigation

Diving into AMMs can be exciting, but it's crucial to understand and assess the risks involved. The target of this section is to provide you with a comprehensive understanding of the risks associated with AMMs and strategies for mitigating them. Impermanent Loss, as we discussed earlier, is a major risk. To mitigate it, choose pools with stable assets or assets that tend to move in similar directions. Smart contract risk is another concern. AMMs rely on smart contracts, which are vulnerable to bugs and exploits. Before investing in an AMM, research its security audits and track record. Liquidity risk is the risk of not being able to withdraw your funds when you need them. This can happen if the pool is too small or if there's a sudden surge in demand. To mitigate liquidity risk, choose pools with sufficient liquidity and avoid illiquid assets.

Regulatory risk is also a factor to consider. The De Fi space is still relatively new, and regulations are constantly evolving. It's important to stay informed about the regulatory landscape and understand how it might impact your investments. By understanding these risks and taking steps to mitigate them, you can significantly improve your chances of success with AMMs. This reinforces the importance of risk management in the context of how to use Automated Market Makers (AMMs) for maximum benefits. By understanding and mitigating these risks, users can protect their investments and increase their chances of achieving sustainable profits in the De Fi space. Effective risk management is not just about avoiding losses; it's about making informed decisions that maximize the potential for long-term success.

Tips for Maximizing Your AMM Yields

Want to squeeze every last drop of profit out of your AMM investments? The target of this section is to provide you with actionable tips and strategies for maximizing your AMM yields. First, compare yields across different AMMs. Some platforms offer higher yields than others, so it's worth shopping around. Consider using yield aggregators, which automatically move your funds to the highest-yielding pools. Reinvest your earnings. Instead of withdrawing your profits, reinvest them back into the pool to compound your returns. Take advantage of incentives and rewards programs. Many AMMs offer incentives and rewards for providing liquidity or trading on their platform. Be sure to participate in these programs to earn extra rewards. Monitor your positions regularly. Keep an eye on your liquidity positions and adjust them as needed based on market conditions. Consider using impermanent loss protection. Some platforms offer insurance or other mechanisms to protect against impermanent loss. By following these tips, you can significantly boost your AMM yields and maximize your profits. This complements the guide on how to use Automated Market Makers (AMMs) for maximum benefits by providing practical strategies for boosting profits. Implementing these tips can help users optimize their returns, but it's crucial to consider individual risk tolerance and market conditions when making investment decisions.

Understanding Gas Fees and Optimization

Gas fees can be a significant expense when using AMMs, especially on networks like Ethereum. The target of this section is to help you understand gas fees and how to optimize them. Gas fees are the transaction fees required to execute smart contracts on a blockchain. They fluctuate based on network congestion. To minimize gas fees, trade during off-peak hours when the network is less busy. Use gas trackers to find the optimal gas prices. Consider using Layer-2 scaling solutions, such as Polygon or Optimism, which offer significantly lower gas fees than Ethereum. Batch your transactions. If you need to perform multiple transactions, try to batch them together to save on gas fees. Use gas tokens, which are tokens that can be used to offset gas costs. By understanding gas fees and implementing these optimization strategies, you can significantly reduce your transaction costs and improve your overall profitability when using AMMs. This is crucial for how to use Automated Market Makers (AMMs) for maximum benefits as high gas fees can eat into profits, especially for smaller trades. By optimizing gas usage, users can reduce their transaction costs and increase their overall profitability.

Fun Facts About AMMs

Did you know that the first AMM was inspired by prediction markets? Or that some AMMs use sophisticated algorithms to minimize slippage? The target of this section is to share some fun and interesting facts about AMMs. One fun fact is that Uniswap was initially developed as a side project by a developer at the Ethereum Foundation. Another fun fact is that some AMMs offer flash loans, which allow you to borrow large amounts of cryptocurrency without collateral, as long as you repay the loan within the same transaction. AMMs have facilitated billions of dollars in trading volume and have revolutionized the way people trade cryptocurrencies. The concept of AMMs has even been applied to other areas, such as prediction markets and insurance. These fun facts illustrate the innovative and transformative nature of AMMs and their impact on the De Fi space. These tidbits add context to how to use Automated Market Makers (AMMs) for maximum benefits by showcasing their innovative origins and widespread impact on the De Fi landscape. Knowing these facts can inspire users to explore AMMs further and appreciate their potential for revolutionizing financial services.

Step-by-Step Guide: How to Provide Liquidity

Ready to become a liquidity provider? The target of this section is to walk you through the process of providing liquidity to an AMM, step by step. First, choose an AMM platform and connect your wallet. Make sure your wallet is compatible with the platform. Select a liquidity pool. Choose a pool that contains tokens you want to provide liquidity for. Determine the amount of each token you want to deposit. You'll need to deposit an equal value of each token. Approve the transaction. You'll need to approve the smart contract to access your tokens. Deposit your tokens. Once the transaction is confirmed, you'll receive liquidity provider tokens, which represent your share of the pool. Monitor your position. Keep an eye on your liquidity position and adjust it as needed based on market conditions. By following these steps, you can easily become a liquidity provider and start earning rewards. This provides a practical guide on how to use Automated Market Makers (AMMs) for maximum benefits by outlining the step-by-step process of becoming a liquidity provider. By following these steps, users can confidently participate in AMMs and start earning rewards, while understanding the mechanics of providing liquidity.

What If AMMs Disappear?

While AMMs are a fundamental part of the De Fi ecosystem, what would happen if they suddenly disappeared? The target of this section is to explore the potential consequences of AMM disappearance and consider alternative scenarios. If AMMs were to disappear, the De Fi landscape would be significantly disrupted. Trading volume would plummet, liquidity would dry up, and the overall efficiency of the market would decrease. Centralized exchanges would likely regain market share, and the benefits of permissionless trading would be lost. However, it's unlikely that AMMs will disappear entirely. They have proven their value and resilience, and new AMM platforms and innovations are constantly being developed. Even if some AMMs were to fail or be replaced by new technologies, the core concept of automated market making is likely to persist. Alternative scenarios include the emergence of more sophisticated AMMs, the integration of AMMs with other De Fi protocols, and the adoption of AMMs by traditional financial institutions. This explores potential risks and alternative scenarios associated with how to use Automated Market Makers (AMMs) for maximum benefits. While the disappearance of AMMs is unlikely, considering such scenarios helps users understand the systemic importance of AMMs and encourages a balanced perspective on their potential risks and limitations.

Top 5 Benefits of Using AMMs

Here's a listicle summarizing the top 5 benefits of using AMMs: The target of this section is to provide a concise overview of the key advantages of using AMMs. 1. Permissionless Trading: Anyone can trade on an AMM without needing to create an account or go through a KYC process.

2. 24/7 Availability: AMMs are always available, 24 hours a day, 7 days a week.

3. Liquidity Provision: Anyone can become a liquidity provider and earn rewards for contributing to the pool.

4. Automated Price Discovery: AMMs use algorithms to automatically determine the price of tokens.

5. Transparency: All transactions on an AMM are publicly recorded on the blockchain. These benefits make AMMs a powerful tool for accessing and participating in the De Fi ecosystem. This provides a concise summary of how to use Automated Market Makers (AMMs) for maximum benefits by highlighting their key advantages. This listicle offers a quick and easy way for users to grasp the core benefits of AMMs and understand why they are a valuable tool in the De Fi ecosystem.

Question and Answer

Here are some frequently asked questions about AMMs:

Q: What is slippage?

A: Slippage is the difference between the expected price of a trade and the actual price you receive. It occurs when there's not enough liquidity in the pool to execute your trade at the expected price.

Q: How do I calculate my impermanent loss?

A: There are several online tools that can help you calculate your impermanent loss. Simply enter the initial price and current price of the tokens in your pool, and the tool will calculate your potential loss.

Q: What are liquidity provider tokens?

A: Liquidity provider tokens are tokens that represent your share of a liquidity pool. You receive these tokens when you deposit tokens into the pool, and you can redeem them to withdraw your funds.

Q: How do I choose the right liquidity pool?

A: Consider factors like the tokens involved, the pool's liquidity, the trading volume, and the potential risks. Also, research the pool's historical performance and the reputation of the platform.

Conclusion of How to Use Automated Market Makers (AMM) for Maximum Benefits

Automated Market Makers (AMMs) have fundamentally changed the landscape of decentralized finance (De Fi), offering users permissionless trading, 24/7 availability, and the opportunity to earn rewards through liquidity provision. By understanding the mechanics of AMMs, mitigating risks like impermanent loss, and implementing effective strategies, you can unlock the full potential of this revolutionary technology and participate in the exciting world of De Fi. Remember to always do your research, start small, and stay informed about the latest developments in the AMM space. With careful planning and execution, you can leverage AMMs to achieve your financial goals and contribute to the growth of the decentralized economy.