Imagine a world where verifying identities and preventing financial crime isn't a tedious, manual process, but a seamless, automated system. A world where regulatory compliance isn't a burden, but a built-in feature. Intrigued? Then read on, because we're diving deep into how smart contracts can revolutionize KYC and AML compliance!

Many businesses grapple with the complexities of adhering to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. The current landscape often involves cumbersome paperwork, repetitive data entry, and a lack of interoperability between different systems. This leads to increased operational costs, slower onboarding processes, and a higher risk of errors and non-compliance.

This article explores how to effectively leverage smart contracts to enhance KYC and AML compliance. We'll delve into the benefits of using blockchain technology to automate identity verification, streamline transaction monitoring, and improve data security, ultimately creating a more efficient and reliable compliance framework.

In short, we're talking about using smart contracts to automate KYC/AML processes, enhancing security and transparency while cutting costs. The key is understanding how blockchain's immutable ledger and programmable logic can be tailored to meet regulatory requirements, creating a more robust and efficient compliance system. Keywords we'll touch on include: smart contracts, KYC, AML, compliance, blockchain, automation, security, and identity verification.

Understanding Smart Contracts in the Context of KYC/AML

The goal here is to understand how smart contracts work and why they are suitable for KYC/AML. I remember when I first heard about smart contracts; it sounded like something straight out of a science fiction movie! The idea of code automatically executing agreements seemed so futuristic. But the more I learned, the more I realized their immense potential, especially in regulated industries like finance. I spent weeks researching how they could automate processes, ensure transparency, and drastically reduce manual intervention. That's when the light bulb went off, and I realized smart contracts could be a game-changer for KYC/AML. Think about it: Instead of manually verifying each document and cross-referencing databases, a smart contract could do it automatically based on pre-defined rules and data sources. This not only speeds up the process but also minimizes the risk of human error and fraud. Smart contracts provide a transparent and auditable record of all transactions, making it easier to comply with regulatory requirements. They also offer enhanced security by encrypting sensitive data and preventing unauthorized access. By automating tasks such as identity verification, transaction monitoring, and risk assessment, smart contracts can significantly reduce the operational costs associated with KYC/AML compliance. This allows businesses to focus on their core activities while maintaining a robust and efficient compliance framework. In addition, smart contracts can be customized to meet the specific needs of different industries and regulatory jurisdictions, ensuring that businesses can adapt to evolving compliance requirements.

Benefits of Using Smart Contracts for KYC/AML

Smart contracts are self-executing agreements written in code and stored on a blockchain. They automatically enforce the terms of a contract when predetermined conditions are met. This automation eliminates the need for intermediaries, reduces the risk of fraud, and ensures transparency and immutability. In the context of KYC/AML, smart contracts can be used to automate identity verification, transaction monitoring, and reporting processes. For example, a smart contract could be programmed to automatically verify a user's identity against a trusted database, such as a government-issued ID or a credit bureau. The contract could also be designed to monitor transactions for suspicious activity, such as large or frequent transfers to high-risk jurisdictions. When suspicious activity is detected, the smart contract could automatically flag the transaction for further investigation or even block it altogether. By automating these processes, smart contracts can significantly reduce the time and cost associated with KYC/AML compliance. They also improve the accuracy and reliability of compliance efforts, reducing the risk of fines and penalties. Furthermore, smart contracts can be integrated with other blockchain-based systems, such as decentralized exchanges and stablecoins, to provide a seamless and secure compliance experience for users.

The History and Evolution of KYC/AML and Smart Contracts

The history of KYC/AML regulations stretches back decades, born from the need to combat financial crimes like money laundering and terrorist financing. These regulations have steadily evolved, becoming increasingly complex and stringent over time. Initially, KYC/AML compliance was a manual, paper-based process, relying heavily on human intervention and susceptible to errors and inefficiencies. The rise of technology led to the adoption of automated systems, but these systems often remained siloed and lacked interoperability. Meanwhile, the emergence of blockchain technology and smart contracts offered a potential solution to these challenges. Smart contracts, with their ability to automate processes and ensure transparency, presented a new paradigm for KYC/AML compliance. However, the adoption of smart contracts in KYC/AML is still in its early stages. There are concerns about the scalability, security, and regulatory acceptance of blockchain-based solutions. Over time, however, the convergence of regulatory requirements and technological innovation is likely to drive wider adoption of smart contracts for KYC/AML. As smart contract technology matures and regulatory frameworks become clearer, businesses will increasingly turn to blockchain-based solutions to streamline their compliance efforts and reduce the risk of financial crime. The ongoing development of KYC/AML regulations and the evolution of smart contract technology is a continuous process. Over time, businesses that adapt to these changes will be best positioned to thrive in an increasingly complex and regulated financial landscape. Ultimately, the future of KYC/AML compliance lies in the effective integration of smart contracts and other blockchain-based technologies.

Unveiling the Hidden Secrets of Securing KYC/AML Compliance with Smart Contracts

The real secret to securing KYC/AML compliance with smart contracts lies in understanding that it's not just about automating processes; it's about building trust and transparency into the system. Many see smart contracts as simply lines of code, but they're actually powerful tools that can create a verifiable and immutable record of all compliance-related activities. For example, by using smart contracts to manage identity verification, you can ensure that all data is securely stored on the blockchain and that any changes are auditable. This eliminates the risk of data tampering and provides regulators with a clear and transparent view of your compliance efforts. Another secret is to focus on interoperability. Smart contracts can be integrated with other systems, such as databases and APIs, to create a seamless flow of information. This allows you to automate data collection and verification, reducing the need for manual intervention and minimizing the risk of errors. It's also important to remember that smart contracts are only as good as the data they rely on. Therefore, it's crucial to ensure that your data sources are reliable and up-to-date. By using trusted data providers and implementing robust data validation procedures, you can ensure that your smart contracts are making accurate and informed decisions. Finally, don't underestimate the importance of collaboration. Securing KYC/AML compliance with smart contracts requires a collaborative effort between legal, technical, and business teams. By working together, you can develop a comprehensive compliance strategy that meets the needs of your organization and complies with all applicable regulations.

Recommendations for Implementing Smart Contracts in Your KYC/AML Strategy

If you're serious about leveraging smart contracts for KYC/AML, start small and iterate. Don't try to overhaul your entire compliance system overnight. Instead, identify specific areas where smart contracts can provide immediate benefits, such as automating identity verification or transaction monitoring. Once you've implemented a successful pilot project, you can gradually expand the use of smart contracts to other areas of your compliance program. Another recommendation is to prioritize data security. When dealing with sensitive customer data, it's essential to ensure that your smart contracts are secure and protected from unauthorized access. This means implementing robust security measures, such as encryption and access controls, and regularly auditing your smart contracts for vulnerabilities. It's also important to comply with all applicable data privacy regulations, such as GDPR and CCPA. Transparency is another key factor to consider. Smart contracts should be designed to provide a clear and transparent view of all compliance-related activities. This means documenting your smart contract code and making it available for review by regulators and other stakeholders. You should also provide users with clear and concise information about how their data is being used and protected. Finally, don't forget about the human element. Smart contracts are powerful tools, but they're not a substitute for human judgment. It's important to have trained personnel who can monitor your smart contracts, investigate suspicious activity, and make informed decisions about compliance issues. Ultimately, the success of your smart contract-based KYC/AML strategy will depend on your ability to balance automation with human oversight.

Key Considerations When Choosing a Smart Contract Platform for KYC/AML

Choosing the right smart contract platform is crucial for the success of your KYC/AML implementation. There are several factors to consider when making this decision. First, consider the platform's scalability. Your KYC/AML solution needs to be able to handle a large volume of transactions and data without compromising performance. Look for a platform that can scale horizontally to meet your growing needs. Another important factor is security. The platform should provide robust security features to protect sensitive customer data. This includes encryption, access controls, and regular security audits. You should also consider the platform's compliance with relevant regulations, such as GDPR and CCPA. Interoperability is another key consideration. Your smart contracts need to be able to interact with other systems, such as databases and APIs. Look for a platform that supports a wide range of integration options. You should also consider the platform's ease of use. The platform should be easy to learn and use, even for non-technical users. This will make it easier to develop and deploy smart contracts for KYC/AML. Finally, consider the platform's cost. Smart contract platforms vary in price, so it's important to choose one that fits your budget. You should also consider the long-term costs of maintaining and upgrading the platform. By carefully considering these factors, you can choose a smart contract platform that meets your needs and supports your KYC/AML goals.

Practical Tips for Building Secure and Compliant Smart Contracts for KYC/AML

Building secure and compliant smart contracts for KYC/AML requires careful planning and execution. First, start by clearly defining your compliance requirements. Understand which regulations apply to your business and what data you need to collect and verify to comply with those regulations. This will help you design smart contracts that meet your specific needs. Next, focus on data security. Implement robust security measures to protect sensitive customer data. This includes encryption, access controls, and regular security audits. You should also comply with all applicable data privacy regulations, such as GDPR and CCPA. Another important tip is to use established smart contract patterns and libraries. These patterns and libraries have been tested and audited by the community, which can help reduce the risk of errors and vulnerabilities. You should also use formal verification methods to ensure that your smart contracts behave as expected. Transparency is also crucial. Make your smart contract code open source and encourage the community to review and audit it. This will help identify potential vulnerabilities and improve the overall security of your smart contracts. Finally, test your smart contracts thoroughly before deploying them to production. This includes unit tests, integration tests, and penetration tests. By following these practical tips, you can build secure and compliant smart contracts for KYC/AML that meet your business needs and protect your customers' data. You should also have a fallback system in place to handle situations where the smart contract malfunctions or fails to execute as expected. Regular audits and security updates are critical for maintaining the integrity of your smart contracts and ensuring compliance with evolving regulations.

Leveraging Oracles for Reliable Data in KYC/AML Smart Contracts

Oracles play a vital role in bringing external data onto the blockchain for use in smart contracts. In the context of KYC/AML, oracles can provide access to crucial information such as identity verification services, sanction lists, and transaction monitoring data. However, it's essential to choose oracles carefully, as their reliability directly impacts the accuracy and trustworthiness of your smart contracts. Ensure that the oracles you use are reputable and have a proven track record of providing accurate and up-to-date information. Another key consideration is decentralization. Centralized oracles can be a single point of failure, so it's preferable to use decentralized oracles that rely on multiple data sources and consensus mechanisms to ensure data integrity. You should also implement robust data validation procedures to verify the accuracy of the data provided by oracles. This can include cross-referencing data from multiple oracles and using statistical analysis to detect anomalies. It's important to remember that oracles are not foolproof and can be vulnerable to attacks or manipulation. Therefore, you should design your smart contracts to be resilient to oracle failures. This can include implementing fallback mechanisms that allow the smart contract to continue functioning even if an oracle becomes unavailable or provides inaccurate data. By carefully selecting and managing oracles, you can ensure that your KYC/AML smart contracts have access to reliable and trustworthy data.

Fun Facts About Smart Contracts and KYC/AML

Did you know that the first smart contract was conceptualized way back in 1994 by Nick Szabo, long before blockchain even existed? He envisioned them as a way to automate contractual clauses. Fast forward to today, and smart contracts are becoming increasingly relevant in highly regulated areas like KYC/AML. Here's another fun fact: While smart contracts are often associated with cryptocurrencies, their applications extend far beyond the crypto world. They can be used in a wide range of industries, from supply chain management to healthcare. In the context of KYC/AML, smart contracts can help reduce the risk of human error and fraud, leading to more accurate and reliable compliance efforts. They can also streamline the onboarding process for new customers, making it faster and more efficient. The adoption of smart contracts in KYC/AML is still in its early stages, but the potential benefits are significant. As technology continues to evolve and regulatory frameworks become clearer, we can expect to see more widespread adoption of smart contracts in the fight against financial crime. For example, the use of zero-knowledge proofs in smart contracts can allow for verification of KYC data without revealing the underlying information, enhancing privacy. Moreover, certain jurisdictions are actively exploring the use of blockchain and smart contracts to create national digital identity systems, which could greatly simplify and improve KYC processes across various industries. The intersection of smart contracts and KYC/AML is a fascinating area with lots of potential for innovation and positive change. The combination of these technologies promises a new era of security, transparency, and efficiency in financial compliance.

How to Build a Compliant KYC/AML Smart Contract System

Building a compliant KYC/AML smart contract system involves several key steps. First, define the scope of your system. Determine which KYC/AML regulations apply to your business and what specific processes you want to automate with smart contracts. Next, design your smart contract architecture. This includes identifying the different smart contracts you need, the data they will store, and how they will interact with each other. Make sure to incorporate security best practices into your design to protect sensitive customer data. Choose a suitable smart contract platform. Consider factors such as scalability, security, compliance, and ease of use. Develop your smart contracts. Write the code for your smart contracts using a secure and reliable programming language such as Solidity. Thoroughly test your smart contracts to ensure they function as expected and don't have any vulnerabilities. Integrate your smart contracts with other systems. Connect your smart contracts to data sources, APIs, and other systems that you need to access for KYC/AML purposes. Deploy your smart contracts to a blockchain network. Choose a network that is secure, scalable, and compliant with relevant regulations. Monitor your smart contracts. Continuously monitor your smart contracts to ensure they are functioning correctly and to detect any suspicious activity. Update your smart contracts as needed. Keep your smart contracts up-to-date with the latest regulations and security best practices. Building a compliant KYC/AML smart contract system is a complex undertaking, but it can provide significant benefits in terms of efficiency, security, and transparency. Be sure to consult with legal and compliance experts throughout the process to ensure that your system meets all applicable requirements. Creating a well-documented audit trail for all smart contract interactions is essential for demonstrating compliance to regulators.

What If Smart Contracts Completely Reshape KYC/AML Compliance?

Imagine a future where KYC/AML compliance is no longer a costly and burdensome process but a seamless and automated function. What if smart contracts completely reshape the landscape of financial regulation? Such a transformation could lead to significant benefits for both businesses and consumers. For businesses, it could mean lower compliance costs, faster onboarding times, and reduced risk of fines and penalties. Smart contracts could automate many of the manual tasks involved in KYC/AML, such as identity verification, transaction monitoring, and reporting. This would free up resources that can be used to focus on core business activities. For consumers, it could mean greater privacy and security. Smart contracts can be designed to protect sensitive customer data and prevent unauthorized access. They can also provide consumers with more control over their data and how it is used. However, there are also potential risks to consider. Smart contracts are still a relatively new technology, and there are concerns about their security and reliability. It is important to ensure that smart contracts are properly tested and audited before they are deployed to production. There are also regulatory challenges to address. Regulators need to develop clear and consistent frameworks for governing the use of smart contracts in KYC/AML. They need to ensure that smart contracts are used in a way that is fair, transparent, and compliant with all applicable laws and regulations. Despite these challenges, the potential benefits of smart contracts in KYC/AML are too significant to ignore. As technology continues to evolve and regulatory frameworks become clearer, we can expect to see more widespread adoption of smart contracts in the fight against financial crime. The adoption of standardized smart contract templates and interoperability protocols would further streamline KYC/AML processes and facilitate collaboration across different institutions. The development of self-sovereign identity solutions, integrated with smart contracts, could also revolutionize the way individuals manage and share their identity data.

Top 5 Use Cases of Smart Contracts in KYC/AML

Let's explore some concrete ways smart contracts are making waves in the KYC/AML space:

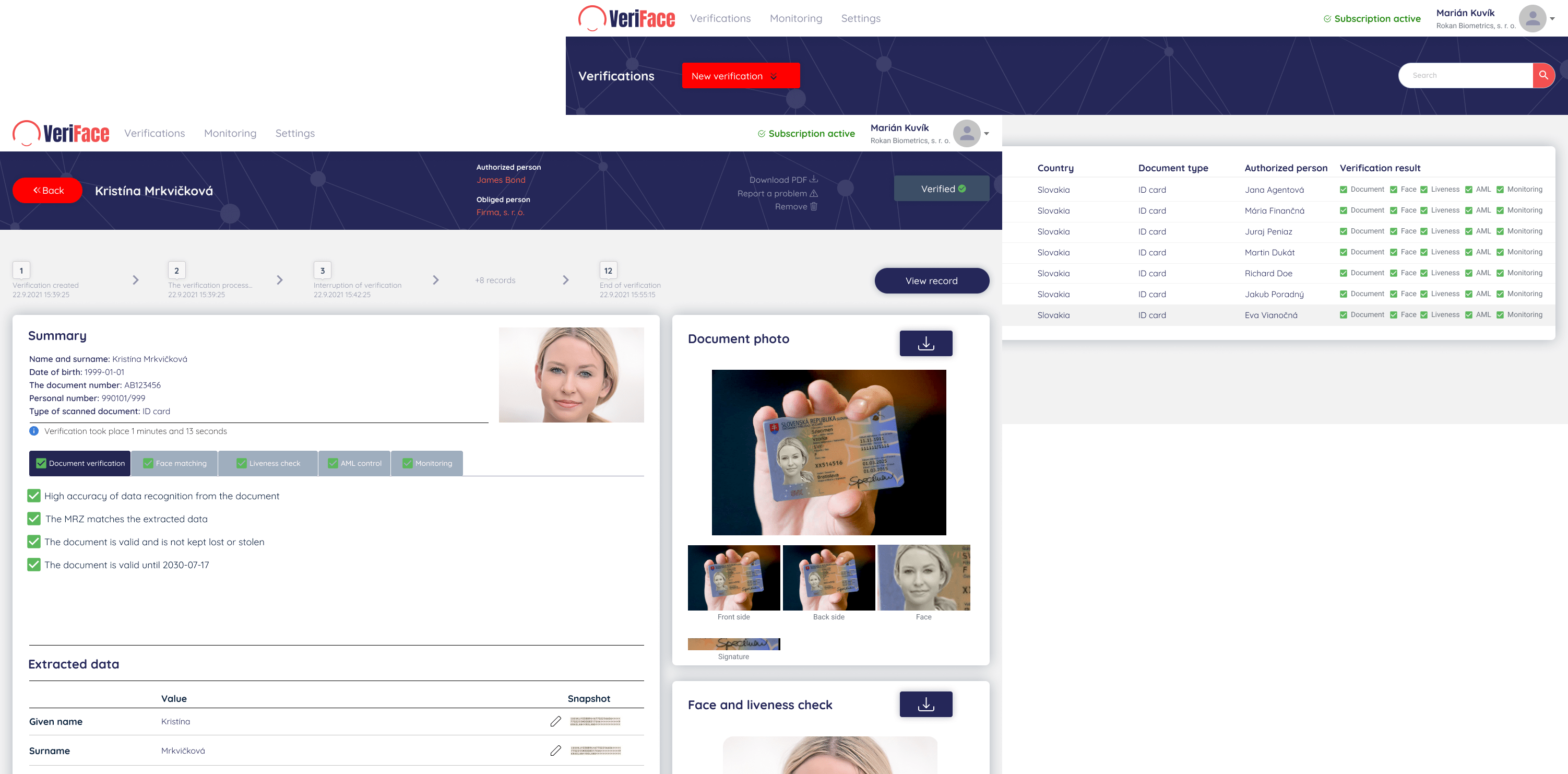

1.Automated Identity Verification: Smart contracts can automatically verify user identities against trusted databases, reducing the need for manual checks and speeding up the onboarding process.

2.Transaction Monitoring: Smart contracts can monitor transactions in real-time for suspicious activity, such as large or frequent transfers to high-risk jurisdictions. When suspicious activity is detected, the smart contract can automatically flag the transaction for further investigation.

3.Sanctions Screening: Smart contracts can automatically screen transactions against sanctions lists to ensure compliance with international regulations. This helps prevent businesses from inadvertently engaging with sanctioned individuals or entities.

4.Data Sharing and Collaboration: Smart contracts can enable secure data sharing and collaboration between different institutions, such as banks and financial institutions. This can help streamline KYC/AML processes and reduce duplication of effort.

5.Regulatory Reporting: Smart contracts can automate the generation of regulatory reports, making it easier for businesses to comply with reporting requirements. This saves time and resources and reduces the risk of errors.

These are just a few examples of how smart contracts can be used to enhance KYC/AML compliance. As technology continues to evolve, we can expect to see even more innovative applications of smart contracts in the fight against financial crime. The integration of AI and machine learning with smart contracts can further enhance the accuracy and efficiency of KYC/AML processes. The ability to create decentralized identity systems, powered by smart contracts, could also empower individuals to control their own identity data and share it securely with trusted parties. The ongoing development of standards and protocols for interoperability between different blockchain platforms will be crucial for enabling seamless data sharing and collaboration across the financial ecosystem.

Question and Answer of How to Secure Your KYC and AML Compliance via Smart Contracts Effectively

Here are some frequently asked questions about securing your KYC and AML compliance using smart contracts:

Q: Are smart contracts a silver bullet for KYC/AML compliance?

A: No, smart contracts are not a silver bullet. They are a powerful tool that can significantly enhance KYC/AML compliance, but they are not a complete solution. You still need to have robust policies, procedures, and human oversight in place.

Q: Are smart contracts secure?

A: Smart contracts can be secure, but they are not immune to vulnerabilities. It is important to use secure coding practices and to thoroughly test and audit your smart contracts before deploying them to production.

Q: Are smart contracts legally binding?

A: The legal status of smart contracts is still evolving. In some jurisdictions, smart contracts are recognized as legally binding agreements. However, in other jurisdictions, their legal status is unclear. It is important to consult with legal counsel to determine the legal implications of using smart contracts in your specific context.

Q: How can I get started with using smart contracts for KYC/AML?

A: Start by educating yourself about smart contracts and blockchain technology. Identify specific areas where smart contracts can provide immediate benefits to your KYC/AML compliance program. Pilot a small project to test the feasibility of using smart contracts in your organization. Consult with experts in smart contract development and KYC/AML compliance to ensure that your implementation is secure and compliant.

Conclusion of How to Secure Your KYC and AML Compliance via Smart Contracts Effectively

Embracing smart contracts for KYC/AML isn't just about adopting a new technology; it's about fundamentally rethinking how we approach regulatory compliance. By automating key processes, enhancing security, and fostering transparency, smart contracts offer a powerful pathway to a more efficient and effective compliance landscape. While challenges remain, the potential benefits are undeniable. By carefully planning, prioritizing security, and staying informed about evolving regulations, businesses can unlock the transformative power of smart contracts and pave the way for a future of seamless and secure financial compliance.