Imagine a world where you can trade your digital assets instantly, without needing a traditional exchange or a middleman. Sounds pretty cool, right? That's the promise of Automated Market Makers, or AMMs, and they're rapidly changing the landscape of decentralized finance (De Fi).

Navigating the world of De Fi can feel like trying to assemble furniture without the instructions. There's a lot of jargon, complex mechanics, and a general sense of uncertainty about where to even begin. Understanding how these new financial tools work is crucial, but the information can often be scattered and difficult to understand.

This guide aims to demystify Automated Market Makers, providing you with a comprehensive understanding of how they function, their benefits, and the potential risks involved. We'll break down the complex concepts into easy-to-understand language, so you can confidently participate in the De Fi revolution.

In this guide, we'll explore the core concepts of AMMs, how they differ from traditional exchanges, and the various types of AMMs that exist. We'll delve into liquidity pools, impermanent loss, and the role of arbitrageurs. You'll learn about the potential benefits of using AMMs, such as increased accessibility and reduced slippage, as well as the risks involved, like smart contract vulnerabilities. By the end, you'll have a solid understanding of how AMMs work and how they're shaping the future of finance, including keywords such as decentralized exchanges, liquidity providers, De Fi protocols, and crypto trading.

Understanding Liquidity Pools

I remember the first time I tried to wrap my head around liquidity pools. It felt like trying to understand a magic trick, but without knowing the secret. I was initially confused about where the assets in these pools came from and how they managed to facilitate trades without a traditional order book. After spending hours researching and experimenting with different AMMs, the concept finally clicked.

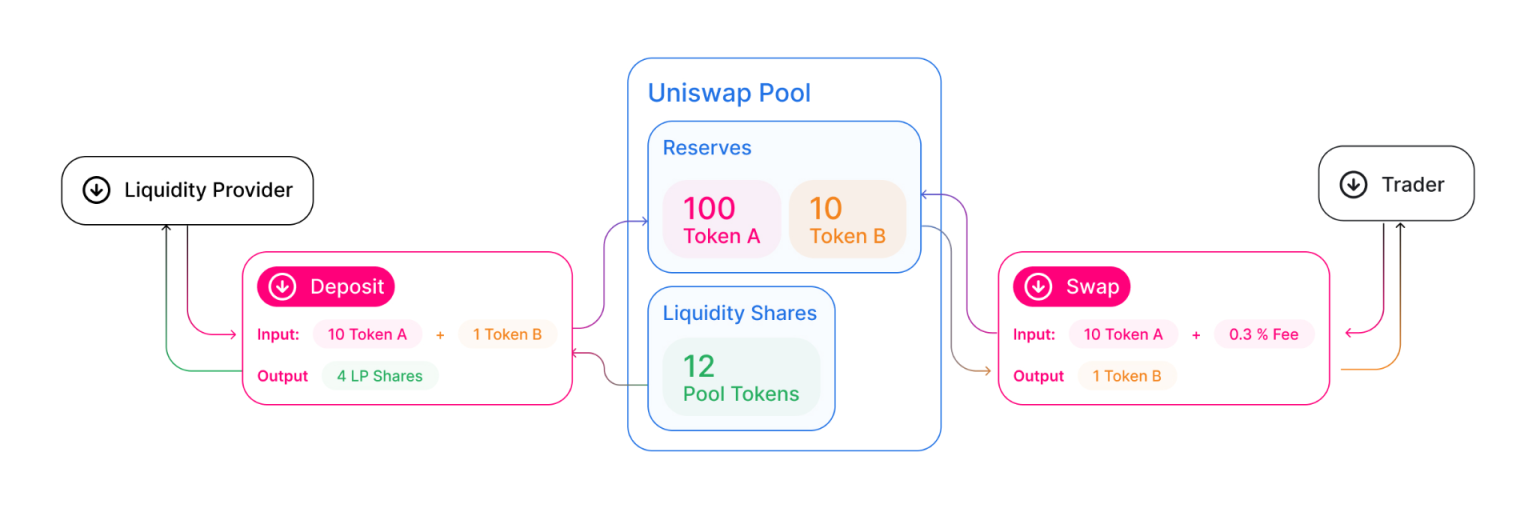

Liquidity pools are essentially large reserves of tokens that are locked in a smart contract. These pools provide the necessary liquidity for traders to execute trades on a decentralized exchange (DEX). Instead of matching buyers and sellers like a traditional exchange, AMMs use these pools to determine the price of an asset based on the ratio of tokens within the pool.

For example, a common pool might contain ETH and DAI. When someone wants to trade ETH for DAI, they add ETH to the pool, which in turn increases the supply of ETH and decreases the supply of DAI. This change in the ratio of tokens affects the price, making DAI slightly more expensive and ETH slightly cheaper. This is a simplified explanation, but it highlights the core mechanism of how AMMs function.

Liquidity providers (LPs) contribute tokens to these pools and in return, they earn a portion of the trading fees generated by the pool. This incentivizes users to provide liquidity, ensuring that there is always enough available for traders to execute their orders. The more liquidity in a pool, the less slippage traders will experience, making it a more efficient and attractive trading environment. Key aspects here include smart contracts, token ratios, and the incentives for liquidity providers within the De Fi ecosystem. Understanding this underlying mechanism is key to navigating the world of AMMs.

The Mechanics of Impermanent Loss

Impermanent loss is a term that often strikes fear into the hearts of new liquidity providers. But fear not! While it's definitely something to be aware of, understanding the mechanics behind it can help you mitigate the risks.

Impermanent loss occurs when the price of the tokens you deposited into a liquidity pool diverge from their initial values. The greater the divergence, the greater the potential for impermanent loss. This is because the AMM is constantly rebalancing the pool to maintain a specific ratio of tokens. When the price of one token increases relative to the other, the AMM will sell off some of the appreciating asset to buy more of the depreciating asset, in order to maintain the desired ratio.

This rebalancing process can lead to a situation where you would have been better off simply holding the tokens in your wallet rather than providing them to the liquidity pool. The loss is considered "impermanent" because it only becomes realized if you withdraw your tokens from the pool. If the prices of the tokens revert to their original values before you withdraw, the loss disappears.

However, it's important to note that impermanent loss can be offset by the trading fees you earn as a liquidity provider. If the fees you earn are greater than the impermanent loss you incur, you can still come out ahead. Therefore, it's crucial to carefully consider the potential risks and rewards before providing liquidity to any pool. Factors to consider include volatility, trading volume, and the fees generated by the pool. It is vital to recognize volatility, trading volume, and fees as key components of impermanent loss assessment. Furthermore, different AMM designs and strategies exist to mitigate impermanent loss, such as those using dynamic fees or adjusting token ratios. Understanding these strategies can help you choose pools that are better suited to your risk tolerance and investment goals, leading to a more profitable and less stressful De Fi experience.

The Evolution of AMMs: From Constant Product to Beyond

The history of AMMs is a fascinating journey of innovation and experimentation. The earliest AMMs, such as Uniswap v1, utilized a simple constant product formula (x y = k) to determine the price of assets. This formula, while elegant in its simplicity, had its limitations, particularly in terms of capital efficiency.

As the De Fi space matured, developers began exploring new and improved AMM designs. Balancer introduced the concept of pools with multiple assets and customizable weights, allowing for more flexibility and diversification. Curve focused on stablecoin swaps, utilizing a different formula that minimized slippage for trades between assets of similar value.

More recently, concentrated liquidity AMMs like Uniswap v3 have emerged, allowing liquidity providers to specify a price range in which they want to provide liquidity. This significantly increases capital efficiency, as liquidity is concentrated around the current market price. However, it also introduces the risk of impermanent loss if the price moves outside of the specified range.

The evolution of AMMs is ongoing, with new designs and features constantly being developed. The goal is to create more efficient, flexible, and user-friendly platforms for decentralized trading. Each iteration of AMMs aims to address the drawbacks of its predecessors, enhancing the De Fi landscape. From the rudimentary x y = k formula to more nuanced and adjustable designs, the path of AMMs reveals an incessant pursuit to improve capital efficiency and user experience. As technology advances, it is possible that we will see hybrid models emerge, combining the best features of different AMM designs to cater to specific asset types or trading strategies.

Unlocking Hidden Secrets: Advanced AMM Strategies

Beyond the basic concepts of liquidity pools and impermanent loss, there are a number of more advanced strategies that can be employed to maximize your returns and minimize your risks as a liquidity provider. One such strategy is to actively manage your liquidity positions, adjusting them as the price of the underlying assets changes.

For example, if you are providing liquidity to a concentrated liquidity AMM like Uniswap v3, you can adjust your price range to stay close to the current market price. This allows you to capture more trading fees and increase your capital efficiency. However, it also requires more active management and increases the risk of impermanent loss if the price moves rapidly.

Another advanced strategy is to use leverage to amplify your returns. Some platforms offer the ability to borrow funds to increase the size of your liquidity position. This can significantly increase your profits, but it also increases your risk of losses. It's crucial to understand the risks involved before using leverage, and to only invest what you can afford to lose.

Furthermore, understanding the underlying smart contract code of an AMM can provide valuable insights into its inner workings and potential vulnerabilities. By analyzing the code, you can identify potential risks and make more informed decisions about which pools to participate in. Understanding advanced strategies will ensure that you make a more informed descision and also increase your chances of generating profit. Therefore, actively managing positions, using leverage cautiously, and auditing smart contracts are strategies that can significantly impact an LP's performance.

Recommendations for Choosing the Right AMM

With a growing number of AMMs available, deciding where to provide liquidity can feel overwhelming. A key recommendation is to carefully consider your risk tolerance and investment goals. Are you looking for high-risk, high-reward opportunities, or are you more interested in stable, lower-risk investments?

Different AMMs cater to different risk profiles. For example, stablecoin-focused AMMs like Curve tend to be lower risk than volatile asset pools on Uniswap. Concentrated liquidity AMMs like Uniswap v3 offer the potential for higher returns, but also come with greater risk of impermanent loss.

Another important factor to consider is the trading volume and liquidity of the pool. Pools with high trading volume and deep liquidity tend to generate more fees and experience less slippage. However, they may also attract more competition from other liquidity providers, which can reduce your share of the fees.

Furthermore, it's essential to research the reputation and security of the AMM platform. Look for platforms that have been audited by reputable security firms and have a proven track record of security. It is also recommended to start with smaller amounts. By doing so, you can familiarize yourself with the platform and strategies without exposing yourself to substantial losses. Understanding your risk tolerance, evaluating trading volume, and assessing the security of the platform are crucial for informed decision-making. Recommendations for AMMs include starting small, diversifying, and always doing your own research.

Understanding Slippage

Slippage is the difference between the expected price of a trade and the actual price you receive. It occurs when there isn't enough liquidity in the pool to execute your trade at the expected price. The larger your trade size relative to the liquidity of the pool, the more slippage you're likely to experience.

AMMs use algorithms to determine the price of assets based on the ratio of tokens in the pool. When you execute a trade, you're essentially changing this ratio, which in turn affects the price. If there isn't enough liquidity to absorb your trade, the price can move significantly, resulting in slippage.

Slippage can be particularly problematic for large trades or when trading illiquid assets. To mitigate the risk of slippage, you can set a slippage tolerance in your trading settings. This tells the AMM the maximum amount of slippage you're willing to accept. If the slippage exceeds your tolerance, the trade will be automatically cancelled.

However, setting a very low slippage tolerance can also prevent your trades from being executed, especially during periods of high volatility. Therefore, it's important to find a balance between protecting yourself from slippage and ensuring that your trades go through. Slippage tolerance, liquidity depth, and trade size all impact the trading outcome. Understanding these factors and making informed decisions can improve your trading experience and profitability on AMMs. Ultimately, understanding the dynamics of slippage and its impact on trading outcomes is crucial for informed decision-making in the AMM ecosystem. Tools like slippage tolerance settings empower users to manage risk and optimize their trading strategies for better outcomes.

Tips for Maximizing Your Returns as a Liquidity Provider

Being a successful liquidity provider requires more than just depositing tokens into a pool. Here are a few tips to help you maximize your returns: Actively monitor your positions. Keep an eye on the price of the underlying assets and adjust your positions as needed. This is particularly important for concentrated liquidity AMMs. Reinvest your earnings. Compounding your returns can significantly increase your profits over time. Many AMMs offer the option to automatically reinvest your earnings.

Diversify your portfolio. Don't put all your eggs in one basket. Spread your liquidity across multiple pools to reduce your risk. Choose pools with high trading volume. Pools with high trading volume tend to generate more fees. However, be aware that they may also attract more competition. Stay informed about the latest developments in the De Fi space. New AMMs and strategies are constantly being developed. Staying informed can help you identify new opportunities and avoid potential risks.

Understand the risks involved. Providing liquidity carries risks, such as impermanent loss and smart contract vulnerabilities. Make sure you understand these risks before investing your money. Use tools and resources to help you make informed decisions. There are a number of tools and resources available to help you analyze AMM pools and track your performance. Tools like De Fi Pulse and analytics dashboards provide insights into pool performance and market trends. By leveraging these tools and resources, you can gain a deeper understanding of the AMM landscape and make more informed investment decisions. Utilizing risk management tools, diversification strategies, and staying informed about market trends can increase the likelihood of profitability in the De Fi landscape. These strategies can help you navigate the complexities of AMMs and improve your chances of achieving your financial goals.

Understanding Gas Fees

Gas fees are a crucial aspect of interacting with AMMs on Ethereum and other blockchain networks. They represent the cost of executing transactions on the blockchain. Understanding how gas fees work is essential for optimizing your trading and liquidity provision strategies. Gas fees fluctuate based on network congestion. When the network is busy, gas fees tend to be higher. Conversely, when the network is less congested, gas fees tend to be lower.

Different AMM operations require different amounts of gas. Simple trades typically require less gas than more complex operations, such as providing or withdrawing liquidity. You can use gas trackers to estimate the current gas prices and choose the optimal time to execute your transactions. Gas trackers provide real-time data on gas prices and can help you avoid paying exorbitant fees.

Some AMMs offer features that can help you reduce gas fees. For example, some platforms batch transactions together to reduce the overall cost. You can also use Layer 2 scaling solutions to execute transactions off-chain and reduce gas fees. Layer 2 solutions like Optimism and Arbitrum offer significantly lower gas fees compared to the Ethereum mainnet. By using these tools and strategies, you can minimize your gas costs and maximize your profits.

Ultimately, understanding gas fees and employing strategies to minimize them can significantly improve your overall experience in the AMM ecosystem. Efficient gas management can help you save money and optimize your trading and liquidity provision strategies. Furthermore, the rise of Layer 2 solutions and gas optimization tools is making De Fi more accessible and affordable for a wider audience. Keeping abreast of these advancements is essential for navigating the evolving landscape of decentralized finance.

Fun Facts About Automated Market Makers

Did you know that the first AMM was actually created in 2014, long before the De Fi craze took off? It was called Bancor, and it pioneered the concept of using a formula to automatically determine the price of assets. The total value locked (TVL) in AMMs has grown exponentially in recent years, reaching billions of dollars. This demonstrates the growing popularity and adoption of these decentralized trading platforms.

AMMs are not just limited to cryptocurrency trading. They can also be used to trade other types of assets, such as tokenized stocks, commodities, and even real estate. Some AMMs are designed to be governance-free, meaning that they are entirely controlled by the smart contract code and cannot be modified by any central authority. AMMs have inspired the creation of a wide range of innovative De Fi protocols, such as yield farms, lending platforms, and insurance products.

The anonymity and decentralized nature of AMMs can be appealing to many users, but it also introduces potential risks, such as smart contract vulnerabilities and regulatory uncertainty. Despite these risks, AMMs are rapidly evolving and are poised to play an increasingly important role in the future of finance. The decentralized nature of AMMs fosters innovation, experimentation, and broader access to financial services. As the technology matures and regulatory frameworks evolve, AMMs are expected to become an integral part of the global financial system. This will open up new opportunities for individuals and institutions alike, driving greater efficiency, transparency, and inclusivity in the world of finance. Their innovative approach to trading and liquidity provision has paved the way for a more decentralized and accessible financial system.

How to Get Started with Automated Market Makers

Ready to dive into the world of AMMs? Here's a step-by-step guide to get you started: Choose a wallet that supports De Fi. Popular options include Meta Mask, Trust Wallet, and Ledger. Fund your wallet with the cryptocurrency you want to trade or provide liquidity with. Connect your wallet to an AMM platform, such as Uniswap, Sushiswap, or Curve. Research the different pools available and choose one that aligns with your risk tolerance and investment goals.

If you're providing liquidity, deposit the required tokens into the pool. If you're trading, enter the amount of tokens you want to exchange and confirm the transaction. Monitor your positions and adjust them as needed. Stay informed about the latest developments in the De Fi space. Start small and gradually increase your position as you gain experience. Don't invest more than you can afford to lose.

Always double-check the smart contract addresses before interacting with any AMM. This will help you avoid scams and phishing attacks. Consider using a hardware wallet for added security. Hardware wallets store your private keys offline, making them less vulnerable to hacking. Be aware of the potential for impermanent loss and take steps to mitigate the risk. By following these steps and tips, you can safely and confidently participate in the exciting world of Automated Market Makers. This careful approach will minimize risks while maximizing your ability to profit. Moreover, with continuous learning and adaptation, anyone can effectively navigate and thrive in the AMM landscape.

What If AMMs Revolutionize Traditional Finance?

Imagine a world where traditional exchanges are replaced by decentralized AMMs. What would that look like? Well, the traditional financial system could become more accessible and transparent. AMMs could provide access to financial services for individuals who are currently excluded from the traditional system. Trading fees could significantly decrease. AMMs eliminate the need for intermediaries, which can reduce trading fees and improve efficiency.

Market manipulation could be reduced. The decentralized nature of AMMs makes it more difficult for market participants to manipulate prices. Innovation in financial products could accelerate. AMMs provide a platform for developers to create and launch new financial products without the need for regulatory approval. Regulatory oversight could become more challenging. Regulating decentralized AMMs would require a new approach that balances innovation with investor protection.

The adoption of AMMs by institutional investors could accelerate. As AMMs become more mature and regulated, institutional investors may begin to allocate a portion of their portfolios to these decentralized trading platforms. The line between traditional finance and decentralized finance could blur. AMMs could become integrated with traditional financial infrastructure, creating a hybrid financial system. Ultimately, the widespread adoption of AMMs could lead to a more efficient, transparent, and inclusive financial system. This would empower individuals and businesses around the world with greater control over their finances. However, these innovations might also raise complex issues related to regulation and risk management that need to be addressed to ensure a smooth transition.

Listicle: Top 5 Benefits of Using Automated Market Makers

Here are the top 5 benefits of using Automated Market Makers: 24/7 Trading: AMMs operate around the clock, allowing you to trade anytime, anywhere. No intermediaries: AMMs eliminate the need for intermediaries, reducing fees and increasing efficiency. Increased accessibility: AMMs provide access to financial services for anyone with an internet connection and a cryptocurrency wallet. Greater transparency: All transactions on AMMs are recorded on the blockchain, providing greater transparency and accountability.

Decentralized governance: Many AMMs are governed by their communities, giving users a say in the future development of the platform. But it's not just about the benefits. Remember to always approach AMMs with caution and do your research. While the benefits are compelling, the risks, especially impermanent loss, should not be ignored. Therefore, a balanced approach, considering both the potential rewards and risks, is essential for successful participation in the AMM ecosystem.

Additionally, exploring platforms that offer tools for risk management and impermanent loss mitigation can further enhance your chances of achieving positive outcomes. Ultimately, the key to success with AMMs lies in informed decision-making, continuous learning, and a proactive approach to risk management. With this approach, you can harness the power of decentralized finance while safeguarding your investments.

Question and Answer About Automated Market Makers

Q: What is impermanent loss?

A: Impermanent loss occurs when the price of the tokens you deposited into a liquidity pool diverge from their initial values. The greater the divergence, the greater the potential for impermanent loss.

Q: How do AMMs determine the price of assets?

A: AMMs use algorithms to determine the price of assets based on the ratio of tokens in the pool. When you execute a trade, you're essentially changing this ratio, which in turn affects the price.

Q: What are the risks of using AMMs?

A: The risks of using AMMs include impermanent loss, smart contract vulnerabilities, and regulatory uncertainty.

Q: How can I mitigate the risk of impermanent loss?

A: You can mitigate the risk of impermanent loss by choosing pools with stable assets, actively monitoring your positions, and using tools to hedge your risk.

Conclusion of The Ultimate Guide to Automated Market Makers

Automated Market Makers are revolutionizing the way we trade and access financial services. By understanding the core concepts, benefits, and risks involved, you can confidently participate in this exciting new world of decentralized finance. As the technology continues to evolve, AMMs are poised to play an increasingly important role in the future of finance. Keep learning, stay informed, and embrace the future of finance!